In this article, we compare invoice factoring and conventional business loans. We discuss: What is a term loan? What is invoice factoring? What do you want to accomplish? Product comparison (7 criteria) Things to keep in mind Which product is right for you? 1. What is a term loan? A term loan (i.e., small business […]

Business Financing

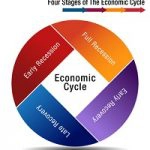

How to Prepare Your Business for a Recession (13 Ways)

The best way for your business to survive a recession is to be prepared ahead of time. Unfortunately, few companies ever prepare for a recession while things are going well. This is a mistake. Instead, most companies make changes after a recession has hit them. This delay limits their choices. This limitation forces companies to […]

Invoice Factoring vs. Business Line of Credit

It’s not unusual for small and midsize businesses to experience cash flow problems from time to time. As a matter of fact, many growing companies encounter financial problems due to their fast growth. The most effective way to solve their cash flow problems is to use financing. The two most common financing solutions that help […]

What is a Line of Credit Secured by Accounts Receivable?

Having cash flow problems is a common challenge for companies of all sizes. Fortunately, many cash flow problems can be solved by improving operations, using financing, or combining both options. This article focuses on how to get financing by using your Accounts Receivable (A/R) as collateral. We cover three financial options that use your A/R: […]

Do You Need Collateral for a Line of Credit?

Getting a business line of credit can be a challenge for small business owners. Most lines are difficult to qualify for and have hefty collateral requirements. For many business owners, this challenge represents an obstacle that a few businesses can overcome. From this article you will learn: Why all lines of credit need collateral The truth about […]

The Best Way to Collect Unpaid Invoices

Summary: Collecting unpaid invoices is probably one of the most tedious tasks of running a business. However, it’s also the most important one. Getting paid on time is vital to the success of a company. It brings in the money to pay employees, suppliers, rent, and yourself. Consequently, it’s essential to handle collections well from […]

Business Line of Credit Qualification Requirements

Business owners who need financing often look for a line of credit. Lines of credit are very flexible and can provide your company with working capital when needed. They can be useful if your revenue is seasonal or if your business is growing quickly and you need money to pay for expenses. Furthermore, lines of […]

How Does a Commercial Line of Credit Work?

Business lines of credit are one of the most popular and most misunderstood financing products for small businesses. This article helps you understand how a line of credit works and gives you an idea of the qualification requirements. More importantly, it helps you decide if a commercial line of credit is the right solution for […]

Finding Money to Start a Small Business (13 Sources)

Finding the money to start their small businesses is usually one of the first problems entrepreneurs face. For most people, this process can be challenging and very frustrating. This experience is often due to a combination of wrong expectations and looking for money in the wrong places. This guide lists thirteen sources of small business […]

How to Get Credit from Suppliers

Most established companies get credit terms from their suppliers. This credit enables companies to buy goods or services while paying the supplier on net-30 to net-60 terms. Clients usually demand payment terms from their suppliers because it improves their cash flow. They get to use the supplier’s services or products for a few weeks before […]