Most small businesses encounter a cash flow problem at one time or another. Fortunately, most cash flow problems can be prevented with a bit of preparation and the right strategy. This article lists the 11 most common causes of cash flow problems, along with ways to solve them. 1. Not having a cash reserve Most […]

How to Offer Net-30 Terms Effectively (Trading Terms)

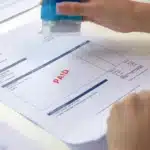

Summary: Waiting 30, 45, or even 60 days to get an invoice paid is a challenge for many business owners. Small companies often have to wait for payment because their commercial sales are made on credit. This type of trade credit is commonly known as “payment terms” or “trading terms.” Companies must offer payment terms […]

What Are Net-30 Trading Terms? How Do They Work?

Summary: Most commercial transactions use payment terms, typically referred to as offering “Net 30 – 60 days” trading terms. These terms are a form of credit that typically gives clients 30 to 60 days to pay an invoice. Companies must offer trading terms if they want to remain competitive, especially when bidding for large opportunities. […]

Should You Offer Early Payment Discounts? (2% / 10 Net 30)

An early payment discount is an incentive that companies receive from suppliers in exchange for a quick payment. It is usually offered by suppliers that need to improve their cash position. In this article, we discuss: 1. Why do you need early payment discounts? Selling to commercial clients can be a challenge for small and […]

Do You Qualify For Invoice Financing?

Invoice financing programmes, also known as invoice factoring, can provide many of the benefits associated with a line of credit. However, they are much easier to qualify for than conventional financing. Most invoice finance companies have fairly simple requirements to qualify. The following is a list of the main requirements to qualify for invoice finance. […]

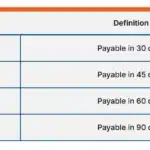

Cash Flow Problems Due to Growth

Sales growth has to be managed correctly, or it can actually bring serious problems to a business. Few entrepreneurs ever consider this outcome because they believe all growth is good. But growing sales too quickly, or getting several very large orders, can create serious cash flow problems. These problems can sometimes be severe enough to […]

Typical Invoice Finance Rates

In this article, we discuss invoice financing rates and the factors that affect the cost of the solution. From this article, you will learn If you are not familiar with invoice finance, consider reading “How does invoice financing work?” before reading this article. If you want a quote, use this form. 1. Administration fee Invoice […]

Pros and Cons of Invoice Financing

Invoice financing, also known as invoice factoring, has been gaining popularity as a way to finance companies that have cash flow problems due to slow-paying commercial clients. It works by providing an advance on these invoices. This advance provides cash flow to operate the business and grow. To learn more details about invoice financing, read […]

Why Do Companies Use Invoice Finance?

Invoice finance, also known as invoice factoring, helps companies that have slow-paying clients. These companies usually can’t wait 30 to 60 days to get paid by clients. Invoice financing addresses this issue by advancing funds against unpaid invoices. It provides businesses withcash pay expenses and grow. Companies often use the funds from invoice finance to: […]

Advantages and Disadvantages of Payroll Financing

Payroll financing has been gaining popularity as an effective way to provide funding to companies that need working capital to pay their employees. Companies with large payrolls often experience cash flow problems because of slow-paying clients. When this happens, the company must pay employees out of its own cash reserves. If the company is growing […]