Smooth out cash flow with invoice factoring

Turn slow-paying invoices into cash quickly. Get funds to pay expenses and take on new work. Trusted for 20+ years

Smooth out cash flow with invoice factoring

Turn slow-paying invoices into cash quickly. Get funds to pay expenses and take on new work. Trusted for 20+ years.

Get an Instant Estimate

*No obligation. Estimate is non-binding.

Turn invoices into cash flow

Factoring works best for companies that invoice creditworthy customers on net terms. We advance funds on approved invoices, so cash flow stays predictable while you wait for payment. Fast approvals and a straightforward process.

Invoice Factoring Financing

Turn outstanding invoices into working capital so cash flow stays on track as customers pay on terms.

Freight Bill Factoring

Advances on freight bills so carriers can keep trucks moving on schedule while waiting to be paid.

Middle-Market Financing

Larger credit facilities for established companies using receivables and other assets. Minimum $1,000,000 in a/r.

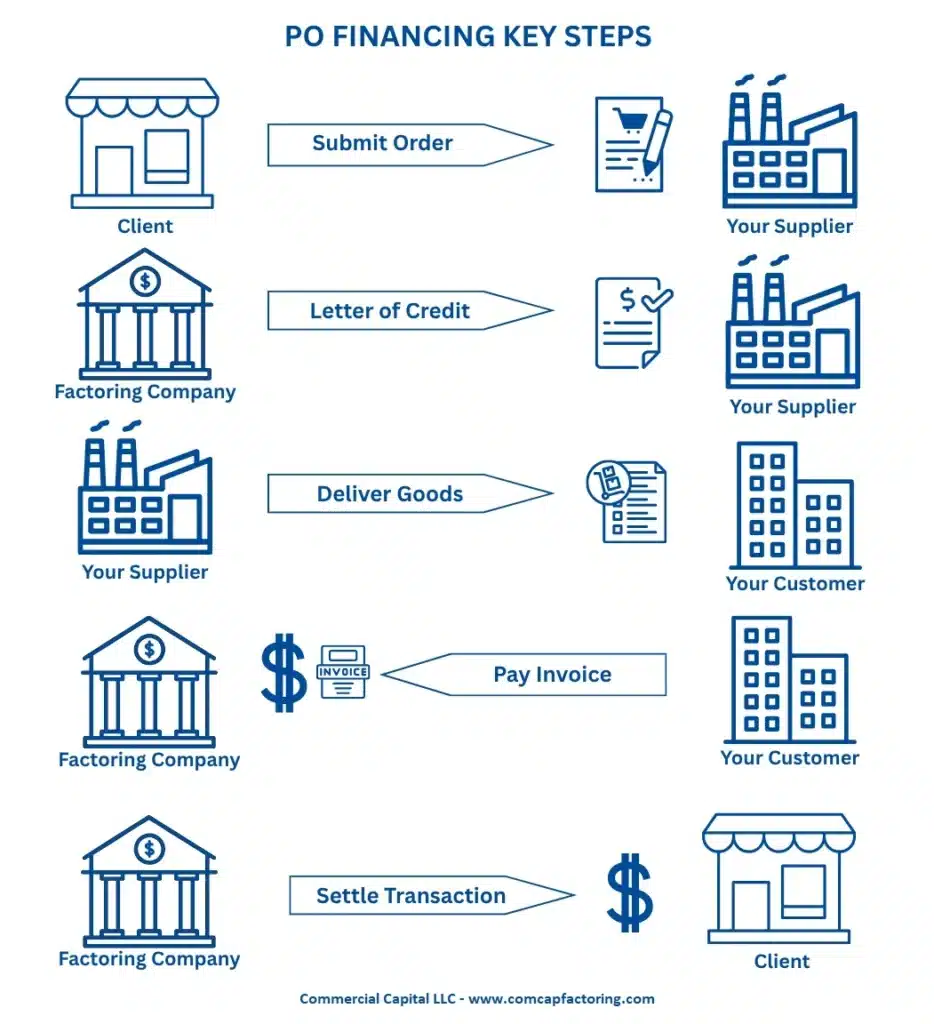

Purchase Order Financing

Cover upfront supplier costs to fulfill confirmed orders, then receive payment when the transaction settles.

Our team has experience across many industries including transportation, manufacturing, construction, staffing, consulting, and healthcare.

Cash flow support for growing companies

Even healthy companies hit timing gaps between delivering work and getting paid. Factoring unlocks cash from approved invoices so you can stay ahead of payroll, materials, and vendor bills.

Get an online estimate or call to walk through your options!

Turn 30 to 90 day payment terms into fast, predictable cash flow with invoice factoring

Predictable Cash Flow

You Stay in Control

Is Factoring A Good Fit

For You?

Factoring works best when you have open invoices and customers who consistently pay on terms and:

Get the Funding You Need

Simply fill out this form, and a credit manager will contact you shortly or call (877) 300-3258 to speak directly to a representative.

We offer competitive factoring rates – as low as 1.15% based on your volume and industry.

*** Rates for other products vary.

Integrity is number one at Commercial Capital. So you can be assured that in every interaction you have with us, we will be honest and straightforward.

Praise for Commercial Capital

A Few Words From Our Founder

Marco Terry

I’ve been helping companies solve their short-term cash flow challenges through trade finance for 20 years. Invoice factoring, purchase order financing, and sales ledger financing are among small and mid-sized businesses’ most valuable financing methods.

The companies most successful with invoice factoring understand it’s a temporary bridge to a longer-term financing solution. For their enduring financial success, companies must plan to transition to another type of funding as soon as possible.