Summary: Waiting 30, 45, or even 60 days to get an invoice paid is a challenge for many business owners. Small companies often have to wait for payment because their commercial sales are made on credit. This type of trade credit is commonly known as “payment terms.” Companies must offer payment terms because their clients […]

Invoice Factoring

Factoring Cost vs. Rates (They are Different)

Summary: To a large extent, business owners think that factoring rates, factoring fees, and the factoring cost of a dollar are all the same. Although they are related, there are important differences. Actually, low factoring rates may translate to lower fees, but may not necessarily translate to lower costs per advanced dollar. This article helps […]

Factoring and Term Loans: A PO Financing Alternative

One of the greatest challenges for a small business is being able to fulfill large purchase orders. Small companies often lack the funds to pay suppliers and other expenses associated with large orders. Most companies try to use financing – when it is available – to solve this problem. One common option is purchase order […]

Why Do Companies Use Factoring?

Factoring is a product that helps companies that have slow-paying clients. These companies usually can’t wait 30 to 60 days to get paid by clients. Factoring solves this problem by financing their invoices. It provides businesses with cash that they can use to run the business. Companies often use the funds from factoring to: 1. […]

Business Loan vs. Invoice Factoring – Which is Better?

In this article, we compare invoice factoring and conventional business loans. We discuss: What is a term loan? What is invoice factoring? What do you want to accomplish? Product comparison (7 criteria) Things to keep in mind Which product is right for you? 1. What is a term loan? A term loan (i.e., small business […]

Supply Chain Financing vs. Invoice Factoring

Supply chain financing is a set of financing tools that allows a company to improve its cash flow. The most common tool in the supply chain financing tool set is reverse factoring. However, there are other tools such as supplier financing and purchase order financing. Invoice factoring, on the other hand, is a trade financing […]

Pros and Cons of Invoice Factoring

Factoring invoices has been gaining popularity as a way to finance companies that have cash flow problems due to slow-paying commercial clients. Factoring works by providing an advance on these invoices. This advance provides cash flow to operate the business and grow. To learn more details about factoring, read “What is invoice factoring?” You can […]

What is Accounts Receivable Factoring?

Accounts receivable factoring is a type of business financing that helps companies with cash flow issues. It allows companies to finance their accounts receivable (A/R), which provides immediate funding. A/R factoring is commonly used by small and growing companies that don’t have large cash reserves. In this article, we cover: 1. Do you provide net-30 […]

What is Factoring?

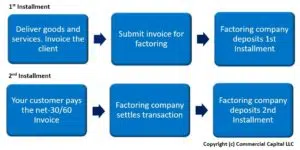

Summary: Factoring is a form of financing that helps companies with cash flow problems due to slow-paying clients. It allows your business to finance invoices, which improves your company’s working capital. Factoring transactions are structured as the sale of accounts receivable rather than as a business loan. Consequently, they can be set up quickly and […]

Invoice Factoring vs. Business Line of Credit

It’s not unusual for small and midsize businesses to experience cash flow problems from time to time. As a matter of fact, many growing companies encounter financial problems due to their fast growth. The most effective way to solve their cash flow problems is to use financing. The two most common financing solutions that help […]