Summary: Asset-based loans are an attractive option for middle-market companies due to their flexibility and relatively low cost. However, they are suitable only for companies with good financial management due to their strong covenants and operational requirements. This article examines stand-alone asset-based financing solutions that can be used as an alternative to asset-based loans. These […]

Blog

The Smart Way to Expand Your Trucking Fleet

Summary: Many owner-operators enter the trucking business hoping to expand their carrier into a large trucking fleet. But few owner-operators grow their companies using a methodical approach. Instead, they jump at the chance of growth without understanding how to grow the business. This approach seldom works and often ends up in financial failure. We recently […]

How to Launch a Trucking Company the Smart Way

Becoming an owner-operator can be very profitable if done correctly. It can also get you into serious financial problems if you are new to the industry and follow the wrong steps. This article was written to help aspiring truckers increase their chances of success in the industry. We cover the the following: The wrong way […]

Smart Strategies for Business Cash Reserves

A cash reserve is a set of funds that a company puts aside to handle financial challenges. It is one of the most important financial resources that a company can develop. A reserve provides financial stability and allows you to operate the business more effectively. Unfortunately, many business owners ignore the importance of having a […]

How Much Debt Can Your Company Handle Safely?

Summary: A heavy debt load can leave a small business vulnerable to financial problems. The business won’t be able to respond to changing market conditions or business emergencies. Unfortunately, many small and midsized companies fail due to excessive debt. Everyone agrees that too much debt is bad. Despite this, there is disagreement over the amount […]

Cash Flow Financing for Small Middle-Market Companies

Summary: Small middle-market companies have fewer financial options than their larger counterparts. Large companies have choices comparable to those of small companies. However, they benefit from better pricing. This article discusses cash flow financing options available to lower middle-market companies. It also includes options that are available to distressed companies. We cover the following: 1. […]

Navigating Asset-Based Loans: Small Business Guide

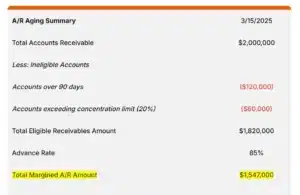

Asset-based loans (ABLs) enable companies to get financing by leveraging their accounts receivable, inventory, and other assets. These loans are a popular option for companies due to their flexibility, simpler qualification requirements, and easier compliance. This guide helps business owners understand how ABLs work, which assets can be financed, what lenders look for, and how […]

Navigating Purchase Order Financing: Small Business Guide

Purchase order (PO) financing has become a popular option for growing resellers and distributors. It helps cover supplier expenses associated with large purchase orders. However, PO financing can be challenging to understand at first. It follows a different structure and has different requirements than typical financial products. This article helps small business owners navigate the […]

Financing Options for Distressed Lower Middle-Market Companies (“Special Assets”)

Summary: Middle-market companies that are out of compliance with their lenders are typically assigned to the Special Assets group. Usually, these companies must find a new lender as part of their workout process. Few lenders finance distressed companies in this market segment. Consequently, finding a replacement lender can be a significant challenge for lower middle-market […]

How Does a Borrowing Base Certificate Work?

A borrowing base certificate is a document that a company uses to draw funds from its asset-based loan (ABL). The certificate is typically used in ABLs secured by accounts receivable since these loans are structured as revolving lines. This article explains how borrowing certificates work and covers the following: 1. What is a borrowing certificate? […]