Work-in-process (WIP) financing is a type of funding that helps cover the supplier expenses of companies that manufacture or assemble goods. It is also known as production financing. 1. What problem does it solve? Companies that manufacture or assemble goods often have a difficult time getting financing. And when they do get financing, the solution […]

Supplier Financing

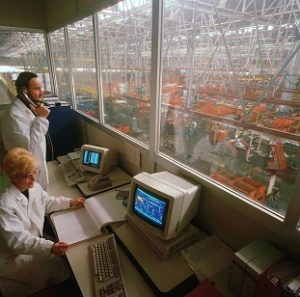

Production Financing for Manufacturing Companies

Managing cash flow is always a challenge for manufacturing company owners. Company managers always walk a fine line trying to balance income and expenses. Paying suppliers, covering overhead, running production, and building inventory all place immediate financial demands on your company. Meanwhile, your clients demand longer payment terms. These conflicting demands affect your cash flow […]

What is Supplier Financing? How Does it Work?

Supplier financing is a component of supply chain financing and plays an important role in improving the cash flow and operations of many companies. It provides companies with credit facilities to buy goods, enabling them to grow the business. This solution is used by manufacturing companies and product distributors. It helps them buy raw materials […]

How Does Supply Chain Financing Work?

Supply chain financing is a general term used to describe a number of financial tools that can be used to improve payments between companies and their suppliers. Supply chain finance solutions can be implemented in various ways. For example, a supplier that is anticipating large orders and wants to build inventory can use “supplier financing.” […]

Supplier Financing vs. Purchase Order Financing

Supply chain financing is a set of tools that companies use to improve their cash flow and their ability to run the business. It offers tools such as reverse factoring, supplier financing, and purchase order financing. Factoring and reverse factoring are post-delivery financing tools. As such, they can help only after you have delivered your […]

Supply Chain Financing vs. Invoice Factoring

Supply chain financing is a set of financing tools that allows a company to improve its cash flow. The most common tool in the supply chain financing tool set is reverse factoring. However, there are other tools such as supplier financing and purchase order financing. Invoice factoring, on the other hand, is a trade financing […]

Supplier Financing Qualification Criteria

Supply chain financing refers to a number of tools that can help a company with its working capital and financial operation. Here is additional information about how it works. This article lists the most important requirements to qualify for supplier financing. To qualify for supplier financing, you should: 1. Be a manufacturer or distributor Supplier financing […]

Supplier Financing for Companies that Sell to Retailers

Getting a contract from a large retailer can be very exciting for any business owner. It can certainly be a defining moment in your career – if you are prepared for it. But large contracts can also be a double-edged sword that can hurt a business that is not well prepared. They can tie up […]

Financing Options for Walmart Suppliers

For many business owners, becoming a Walmart supplier can be a defining moment in their business careers. Walmart’s massive scale, when approached correctly and strategically, can help your business grow exponentially. The bottom line is that Walmart is a great company with stores in the US and Canada (among other countries) and can make for a great client. […]