Invoice financing programmes, also known as invoice factoring, can provide many of the benefits associated with a line of credit. However, they are much easier to qualify for than conventional financing. Most invoice finance companies have fairly simple requirements to qualify. The following is a list of the main requirements to qualify for invoice finance. […]

Invoice Finance

Typical Invoice Finance Rates

In this article, we discuss invoice financing rates and the factors that affect the cost of the solution. From this article, you will learn If you are not familiar with invoice finance, consider reading “How does invoice financing work?” before reading this article. If you want a quote, use this form. 1. Administration fee Invoice […]

Pros and Cons of Invoice Financing

Invoice financing, also known as invoice factoring, has been gaining popularity as a way to finance companies that have cash flow problems due to slow-paying commercial clients. It works by providing an advance on these invoices. This advance provides cash flow to operate the business and grow. To learn more details about invoice financing, read […]

Why Do Companies Use Invoice Finance?

Invoice finance, also known as invoice factoring, helps companies that have slow-paying clients. These companies usually can’t wait 30 to 60 days to get paid by clients. Invoice financing addresses this issue by advancing funds against unpaid invoices. It provides businesses withcash pay expenses and grow. Companies often use the funds from invoice finance to: […]

Selling Accounts Receivable to Finance Your Business

Companies experience cash flow problems at one point or another. These issues are common in small businesses and companies growing quickly. Cash flow problems can usually be fixed using the correct type of financing. However, getting a business loan or a line of credit remains out of reach for many small and midsize businesses. This […]

Why Would a Company Sell Its Accounts Receivable?

Companies sell their accounts receivables to improve their cash flow. Having good cash flow is essential if you want to run a successful business. You can have a great product/service and excellent profit margins, but your business will suffer if your cash flow is bad. As a matter of fact, profitable companies can also have […]

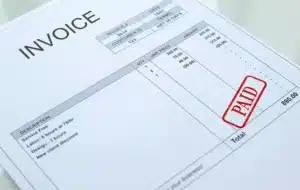

Can I Sell My Invoices to Improve My Cash Flow?

Small business owners are often challenged when a large customer requests 30 to 90 days of credit to pay an invoice. As a business owner, you want to offer credit terms because it improves your ability to sell to large clients. However, offering credit terms can also hurt your company if you don’t have financial […]

How Does Invoice Financing Work?

Summary: Invoice financing, also known as invoice factoring, is a type of debtor finance that helps improve the cash flow of companies that have slow-paying invoices. This form of financing gives the client access to immediate funds, which can then be used to pay for business expenses and to grow. In this article, we show […]

Is Invoice Finance Right for Your Business?

Invoice finance is a solution that is becoming popular with small and midsize companies. This article helps you determine if invoice finance is the right solution for your company. We guide you through eight questions to ask before considering an invoice financing facility. 1. Can my cash flow problem be fixed using invoice finance? The […]

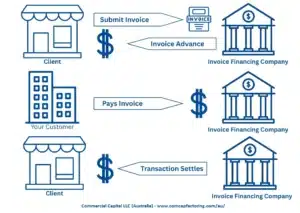

How Do Invoice Finance Companies Buy Receivables?

One of the advantages of invoice financing is that most transactions are not structured as loans. Instead, the client sells their accounts receivable to the finance company in exchange for an immediate payment. This article describes how a company sells their invoices to a finance and covers the following subjects: 1. Invoice financing basics Invoice […]