Summary: Waiting 30, 45, or even 60 days to get an invoice paid is a challenge for many business owners. Small companies often have to wait for payment because their commercial sales are made on credit. This type of trade credit is commonly known as “payment terms” or “trading terms.” Companies must offer payment terms […]

Frequently Asked Questions

What Are Net-30 Trading Terms? How Do They Work?

Summary: Most commercial transactions use payment terms, typically referred to as offering “Net 30 – 60 days” trading terms. These terms are a form of credit that typically gives clients 30 to 60 days to pay an invoice. Companies must offer trading terms if they want to remain competitive, especially when bidding for large opportunities. […]

Should You Offer Early Payment Discounts? (2% / 10 Net 30)

An early payment discount is an incentive that companies receive from suppliers in exchange for a quick payment. It is usually offered by suppliers that need to improve their cash position. In this article, we discuss: 1. Why do you need early payment discounts? Selling to commercial clients can be a challenge for small and […]

Why Would a Company Sell Its Accounts Receivable?

Companies sell their accounts receivables to improve their cash flow. Having good cash flow is essential if you want to run a successful business. You can have a great product/service and excellent profit margins, but your business will suffer if your cash flow is bad. As a matter of fact, profitable companies can also have […]

Can I Sell My Invoices to Improve My Cash Flow?

Small business owners are often challenged when a large customer requests 30 to 90 days of credit to pay an invoice. As a business owner, you want to offer credit terms because it improves your ability to sell to large clients. However, offering credit terms can also hurt your company if you don’t have financial […]

Is Invoice Finance Right for Your Business?

Invoice finance is a solution that is becoming popular with small and midsize companies. This article helps you determine if invoice finance is the right solution for your company. We guide you through eight questions to ask before considering an invoice financing facility. 1. Can my cash flow problem be fixed using invoice finance? The […]

What is a Notice of Assignment? (Invoice Financing)

A Notice of Assignment (NOA) is a document that debtor finance companies send to the end-customers of their clients. This document informs end-customers of the invoice finance relationship. Clients usually have some concerns when they learn that a debtor finance company will notify their customers. This article addresses these concerns and explains how the NOA […]

How Do Invoice Finance Companies Buy Receivables?

One of the advantages of invoice financing is that most transactions are not structured as loans. Instead, the client sells their accounts receivable to the finance company in exchange for an immediate payment. This article describes how a company sells their invoices to a finance and covers the following subjects: 1. Invoice financing basics Invoice […]

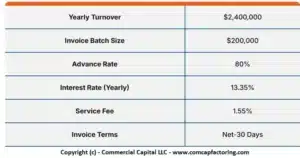

Debtor Finance Interest Rates

Summary: This article provides an overview of the typical financing rates for the two leading debtor finance products. It explains how debtor financing companies determine your rates and how those rates are applied in a transaction. We cover the following information: If you are not familiar with debtor financing, read “What is Debtor Financing?” to […]

How are Invoice Verifications Done?

Summary: Debtor finance companies can finance an invoice only after it has been verified. This article helps you understand why invoices are verified and how the process works. We cover the following: What is debtor finance? How are invoices verified? How are problem invoices handled? 1. Understanding debtor finance Debtor finance, also known as invoice […]