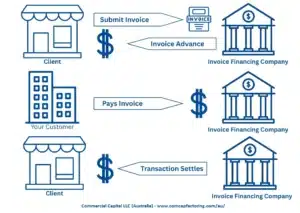

Summary: Debtor finance companies can finance an invoice only after it has been verified. This article helps you understand why invoices are verified and how the process works. We cover the following: What is debtor finance? How are invoices verified? How are problem invoices handled? 1. Understanding debtor finance Debtor finance, also known as invoice […]

Invoice Finance

Debtor Financing v. Overdrafts

Summary: Small companies that experience short-term cash flow problems often have few alternatives. Their available options often include getting funds from investors, a business loan, an overdraft facility or using a debtor financing programme. In this article, we compare debtor financing to an overdraft facility to help you determine which one is better for your […]

What is Invoice Finance? How Does it Work?

Summary: Invoice financing, also called invoice factoring, is a type of debtor finance that helps companies with cash flow problems due to slow-paying clients. It allows your business to finance invoices, which improves your company’s working capital. Transactions are structured as the sale of accounts receivable rather than as a business loan. Consequently, they can […]

How Much Does Invoice Finance Cost? (Detailed Explanation)

This article explains how to invoice financing fees work and how much it costs to use the programme. It also provides an example that shows how these fees are calculated and how they are applied. You will learn the following: 1. How does invoice finance work? This article assumes that you are already familiar with […]