Summary: Debtor financing is an umbrella term for products that finance accounts receivable. It’s typically used when referring to invoice financing or invoice discounting.

Invoice financing, also known as invoice factoring, is suitable for small and medium enterprises (SME). On the other hand, invoice discounting is suitable for larger companies with an established track record.

This article explains invoice finance, since it is the most common debtor finance solution. It covers the following subjects:

- What is debtor finance?

- Transaction structure

- How does it work?

- Average costs

- Advantages

- Invoice finance vs. invoice discounting

1. What is debtor finance?

Companies typically operate on 30-day to 60-day trade terms. However, offering terms to business clients can lead to cash flow problems. These problems often affect companies that are growing quickly or don’t have adequate cash reserves.

Debtor financing is an umbrella term for products that solve these cash flow problems by financing your accounts receivable. The two most common forms of debtor financing are invoice financing and invoice discounting. Both solutions solve the same problem and provide similar benefits. However, they work differently and offer different features.

Invoice financing, also known as invoice factoring, is used by smaller companies. It provides three services – funding, credit advice, and collections assistance. Invoice discounting, on the other hand, only provides financing. It is used by larger companies with an established receivables department.

Read “What is debtor finance?” to learn more.

2. Transaction structure

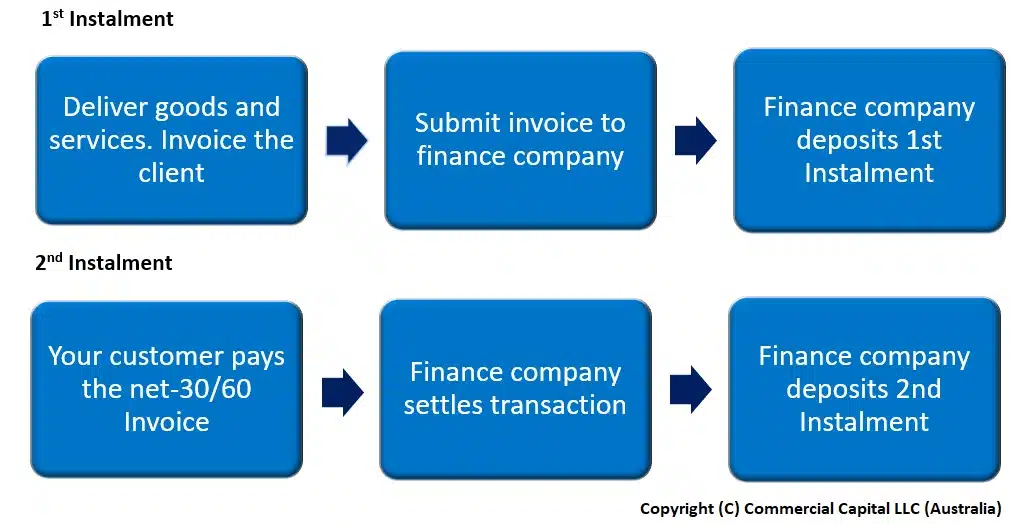

Debtor finance transactions have a simple structure. Finance companies typically finance your accounts receivable in two instalments.

The first instalment covers 70% to 85% of the invoice. It is deposited into your bank account shortly after the debtor finance company processes the invoice.

The remaining 15% to 30 %, less the finance fees, is deposited once your client pays their invoice, typically on net-30 to net-60 day terms. This second instalment settles the transaction.

3. How does debtor finance work?

Debtor finance companies can set up an invoice financing account relatively quickly. In general, simple transactions can be set up in a few days. Once the account is set up, it can finance invoices for approved debtors.

The following steps explain the process in detail.

Step #1: Account setup

The process starts when the financing company begins its due diligence. As part of its due diligence, the finance company reviews:

- That your business is properly organized

- That your clients have good commercial credit

- That your invoices are not pledged as security

- Your financial statements

- Your credit and collections procedures

Debtor finance companies can only finance invoices from commercial clients with good payment histories. Consequently, your clients must have good business credit.

The due diligence process usually takes a few days. However, it can take longer for more complex or larger transactions. Once the contract is signed, the debtor finance company begins setting up your account so your invoices can be financed

Step #2: Debtor notifications

The debtor finance company will need to send a Notice of Assignment (NOA) letter to each of your customers. The NOA is sent only once to your customers, at the start of the relationship.

Debtor financing company uses this letter to inform the customer of the new payment instructions. Invoice finance is widely used by most of your customers, especially larger companies. Consequently, they should be familiar with these letters.

Step #3: Submit invoices

Most debtor finance companies allow you to submit invoices by uploading them through a portal or through your accounting software (varies). The finance company needs to verify your invoices to ensure they are:

- Accurate

- Free of disputes and problems

- Due in less than 60 days

The verification process is typically done through your client’s vendor portal. Alternatively, they can be done by email or a phone call. For more information about the verification process, read “How are Invoice Verifications Done?”

Step #4: Funds disbursement

Once your invoices are verified, the debtor finance company will deposit the funds into your bank account. The initial disbursement can cover 70% to 85% of the invoice, as outlined in your financing contract. The disbursement starts the clock for the fees.

Step #5: Invoice payment and second disbursement

The invoice remains open until your customer submits a payment. Once the payment is received, the invoice is settled. The remaining 15% to 30%, less the financing fees, are deposited into your account to settle the transaction.

Step #6: Ongoing use

You can repeat steps #3 – #5 as you raise new invoices for existing customers. Any new customers must be notified (Step #2) before you can submit their invoices for financing.

4. How much does it cost?

Finance companies adjust their fees based on the size of the line, the credit quality of your invoices, and the overall transaction risk. Most debtor financing lines have an administration fee and an interest rate.

The administration fee can go from 0.80% to 2.50% and is charged when an invoice is uploaded. It covers the cost of managing the invoice.

The interest rate is charged on the utilised funds (e.g., the advanced funds) and accrues daily. The yearly rate is determined by combining a reference rate, market conditions, and transaction risk. It can go from 11.35% to 14.85% per annum. Note that these rates are approximations and change with market conditions.

Read “How much does debtor finance cost?” to learn more.

5. Advantages

Debtor finance lines have several advantages over other financing solutions. These include the following.

a) Improves cash flow quickly

The main advantage of a debtor financing line is that your cash flow improves quickly. The line can eliminate cash flow problems associated with slow-paying invoices. Consequently, your company will have the funds to cover essential business expenses and growth.

b) Simple qualification criteria

Invoice financing and invoice discounting have simpler qualification criteria than comparable solutions. The main difference in the requirements is that invoice discounting is better suited for larger companies that are more established.

c) Adaptive growth

Debtor finance lines can adapt to your business. The financing line can increase to match your yearly turnover growth, provided you work with quality clients. Consequently, debtor financing is ideal for fast-growing companies.

d) No real estate security required

Debtor financing lines are secured by the company’s assets. Most lines don’t require the business owners to use real estate as security.

6. Invoice financing vs. invoice discounting

Invoice financing and invoice discounting lines operate differently and have distinct qualification requirements. Invoice financing is intended for smaller companies. Consequently, it has simpler qualification requirements.

Invoice discounting, on the other hand, is intended for larger companies whose yearly turnover exceeds $3,600,000. The company must have a good track record and good financial controls. Consequently, it’s better suited for larger companies.

a) Debtor notifications

Invoice discounting lines don’t require a conventional NOA. Instead, most debtors are provided with simple change of account letter. This approach allows most invoice discounting lines to operate as confidential facilities.

b) Operations

The most noticeable operational difference is how advances are processed. Your company will need to provide accurate invoicing and payment reports so the debtor finance company can manage your line. Consequently, your accounts receivable team must keep all information up to date.

Can we help you?

We are a leading provider of debtor financing. Our invoice factoring and invoice discounting programmes offer high advances at low rates. For more information, submit the enquiry form.