The invoicing and collections process is one of the most important jobs at any company. Growing companies have to be good at getting paid for their products/services. Timely payments provide you with the cash flow to pay wages, suppliers and other important expenses. Collecting unpaid invoices doesn’t have to take a long time or be tedious. With […]

Blog

Financing For Roofing Contractors

Summary: One of the challenges of working as a roofing contractor is that most clients pay you 30 to 60 days after you raise an invoice or progress claim. End employers and principal contractors often demand net-30 payment terms as a condition of working with them. However, this demand affects your cash flow and could […]

How to Finance a Construction Company (Trade Contractor)

Summary: Getting paid is always a challenge in the construction industry, especially for subcontractors. Most construction trade contractors work with principal contractors and end employers under a contractual arrangement that uses progress claims. The subcontractor raises an invoice once a stage of the project is completed and then waits 30 to 60 days to get […]

How to Choose the Right Debtor Financing Company

Debtor financing is an umbrella term that refers to a number of cash flow financing products. The two most common debtor financing products are invoice factoring and invoice discounting. Companies use debtor finance because they have financial problems due to slow-paying clients. Often, they need to offer net 30 terms to clients even though they can’t afford […]

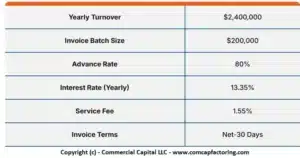

Debtor Financing Costs Explained

Summary: Debtor financing is an umbrella term products that finance your accounts receivable. The two most common products are invoice financing and invoice discounting. This article helps you understand the rates and fees associated with these two solutions. This article assumes that you are familiar with how factoring and invoice discounting work. We cover the […]

Differences Between Factoring and Invoice Discounting

Summary: Invoice discounting and invoice factoring offer financing based on your accounts receivable. Both products offer similar benefits to client. While there are similarities between these products, there are also a number of important differences. This article helps you understand the main differences between factoring and invoice discounting so that you can make an educated […]

Advantages of Debtor Finance

Debtor finance solutions have been gaining popularity in Australia as a way to finance growing companies that need cash flow. This article presents the most important advantages of this product to help you determine if this financing programme is right for your company. If you are not familiar with debtor finance, read “What is Debtor Finance?” first. 1. […]

Disadvantages of Debtor Finance

Like any business financing solution, debtor financing has a number of advantages and disadvantages. This article presents the most important disadvantages of this product to help you determine if this financing solution is right for your company. 1. Debtor finance solves only one specific problem The most important limitation of debtor finance is that it […]