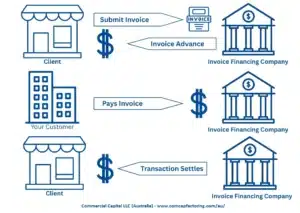

One of the advantages of invoice financing is that most transactions are not structured as loans. Instead, the client sells their accounts receivable to the finance company in exchange for an immediate payment. This article describes how a company sells their invoices to a finance and covers the following subjects: 1. Invoice financing basics Invoice […]

Blog

How to Find Clients for a Labour Hire Agency (12 Ways)

One of the skills needed to run a labour hire agency is knowing how to find and get profitable clients. The Australian labour hire market is very competitive. Many labour hire and recruitment agencies are often chasing the same contracts. To succeed, you must know where to find these opportunities – and how to get […]

Debtor Finance Interest Rates

Summary: This article provides an overview of the typical financing rates for the two leading debtor finance products. It explains how debtor financing companies determine your rates and how those rates are applied in a transaction. We cover the following information: If you are not familiar with debtor financing, read “What is Debtor Financing?” to […]

How Does Debtor Finance Work?

Summary: Debtor financing is an umbrella term for products that finance accounts receivable. It’s typically used when referring to invoice financing or invoice discounting. Invoice financing, also known as invoice factoring, is suitable for small and medium enterprises (SME). On the other hand, invoice discounting is suitable for larger companies with an established track record. […]

How are Invoice Verifications Done?

Summary: Debtor finance companies can finance an invoice only after it has been verified. This article helps you understand why invoices are verified and how the process works. We cover the following: What is debtor finance? How are invoices verified? How are problem invoices handled? 1. Understanding debtor finance Debtor finance, also known as invoice […]

Debtor Financing v. Overdrafts

Summary: Small companies that experience short-term cash flow problems often have few alternatives. Their available options often include getting funds from investors, a business loan, an overdraft facility or using a debtor financing programme. In this article, we compare debtor financing to an overdraft facility to help you determine which one is better for your […]

What is Invoice Discounting? How Does It Work?

Summary: Invoice discounting is a form of debtor finance that provides companies with a revolving line of financing secured by accounts receivable. It’s typically used by midsized companies that want to improve their cash flow. This article explains how invoice discounting works, its costs, and how it compares to invoice financing. We cover the following […]

What is Invoice Finance? How Does it Work?

Summary: Invoice financing, also called invoice factoring, is a type of debtor finance that helps companies with cash flow problems due to slow-paying clients. It allows your business to finance invoices, which improves your company’s working capital. Transactions are structured as the sale of accounts receivable rather than as a business loan. Consequently, they can […]

What is Debtor Finance? How Does it Work?

Summary: Debtor financing is an umbrella term for products that finance accounts receivable. The most common debtor finance solutions are invoice financing and invoice discounting. Invoice financing and discounting are used by companies that offer 30- to 60-day terms to customers but have problems waiting for payments. It works by funding slow-paying invoices, which improves […]

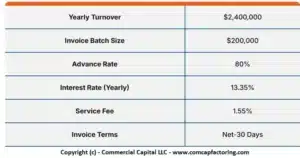

How Much Does Invoice Finance Cost? (Detailed Explanation)

This article explains how to invoice financing fees work and how much it costs to use the programme. It also provides an example that shows how these fees are calculated and how they are applied. You will learn the following: 1. How does invoice finance work? This article assumes that you are already familiar with […]