Temporary staffing businesses can be very profitable if managed correctly. However, managing a successful agency is not easy. There is a lot of competition – at least in some markets. You must know how to differentiate your agency, recruit talent, and attract clients – all while dealing with competitors that are vying for the same […]

Staffing Agencies

How to Start and Grow a Staffing Agency

When managed correctly, temporary staffing agencies can grow quickly and be very profitable. They represent a great opportunity for the right individual (or group). However, agencies have a lot of moving parts. They need owners/managers who have expertise in many areas. 1. The basics: How does a staffing agency make money? Temporary staffing agencies lease […]

How to Find Clients for a Staffing Agency (12 Ways)

One of the skills needed to run a successful staffing agency is knowing how to find and get profitable clients. The Canadian staffing market is very competitive. Many temporary employment agencies are often chasing the same contracts. To succeed, you must know where to find these opportunities – and how to get them. In this […]

Payroll Financing for Staffing Companies

Making payroll is the most critical task for any growing staffing agency. You can retain high-quality talent only if you offer good salaries, good jobs, and you pay on time. However, cash flow problems jeopardize your ability to pay employees on time and prevent your company from reaching its true potential. In this article, we […]

How to Finance a Technology Staffing Company

Summary: Most staffing companies are launched by entrepreneurs who have a vision but little start-up capital. The companies operate on tight cash flows for their first few years as they grow the client roster. However, growing a company with a tight cash flow is challenging and carries significant risks. All it takes are a couple […]

How to Finance a Consulting Firm

Summary: Most consulting companies are launched with very little capital and few assets. They usually do not have a substantial cash reserve. The company operates month-to-month, using incoming revenues to cover expenses. This approach can work for small companies. However, it can create financial problems if your company is growing. This article discusses how to […]

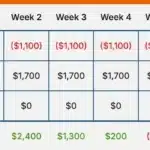

Why do Staffing Agencies Get Higher Factoring Advances?

Summary: Most factoring companies advertise that they provide an advance of 80% to 90% of the invoice, depending on the client’s industry. For example, a manufacturing company with solid clients will likely get an advance of 80% to 85%. On the other hand, a staffing agency with similar clients will get a 90% advance. This […]