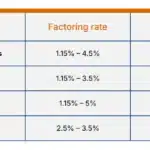

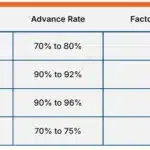

In this article, we discuss factoring rates and how to use rates to determine the total cost of using this solution. From this article, you will learn: If you are not familiar with factoring, consider reading “How does factoring work?” before reading this article. If you just want an instant rate quote, try this form. […]

Invoice Factoring

Advantages and Disadvantages of Non Recourse Factoring

Non-recourse invoice factoring plans have quickly become very popular with Canadian companies that are looking for a factoring plan. The main advantage of non-recourse plans is that the factoring company absorbs the loss of advance, if your customer does not pay due to a credit reason. Factoring companies use different rules to define what is a qualifying ‘credit […]

What is Non-Recourse Factoring?

Non-recourse factoring is a type factoring financing in which the factoring company assumes the loss if invoices are not paid due to end customer insolvency. It is one of the two common types of invoice factoring offered by Canadian factoring companies. However, it is also widely misunderstood by clients. In this article, we discuss: 1. […]

How Much Does Factoring Cost?

This article explains how to calculate the factoring fees of a factoring proposal. It covers the three most common proposal fee types: flat-rate, variable-rate, and discount-plus-margin. We cover the following: 1. How does factoring work? This article assumes that you are already familiar with factoring and know how it works. Here is a short summary […]

How Do Factoring Companies Buy Accounts Receivable?

One of the advantages of invoice factoring is that most transactions are not structured as loans. Instead, the client sells their accounts receivable to the factoring company in exchange for an immediate payment. This article describes how a company sells their invoices to a factor and covers the following subjects: 1. Factoring basics Invoice factoring […]

Can I Sell My Invoices to Improve My Cash Flow?

Small business owners are often challenged when a large customer requests 30 to 90 days of credit to pay an invoice. As a business owner, you want to offer credit terms because it improves your ability to sell to large clients. However, offering credit terms can also hurt your company if you don’t have financial […]

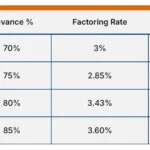

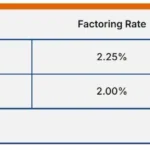

How to Compare Factoring Company Rates

Most people use a simple approach when comparing proposals from competing factoring companies. They make their decision based on who offers the lowest rate and the lowest application fee. While this strategy is common, it can lead to making a wrong decision. This is because the lowest rate does not always equal the lowest cost, […]

Are Factoring Rates That Important?

Most prospective clients consider the factoring rate the most important feature of a plan. In fact, pricing is usually the first question clients ask prospective finance companies. Seeking the best rate is a good strategy, but it should not be the only detail you look for. Other parts of a plan are just as important. […]

Selling Accounts Receivable to Finance Your Business

Companies experience cash flow problems at one point or another. These issues are common in small companies and in companies that are growing quickly. Cash flow problems can usually be fixed using the correct type of financing. However, getting a bank loan or a line of credit remains out of reach for many small and […]

Is Invoice Factoring Right for Your Business?

Invoice factoring is a business financing solution popular with small and midsize companies. This article helps you determine if factoring is the right solution for your business. We guide you through eight questions to ask before considering a factoring facility. 1. Can my cash flow problem be fixed using factoring? The first question to ask […]