Summary: The Special Assets department handles loans that are out of compliance and in trouble. Lenders assign loans to this department to mitigate potential losses. This change marks a turning point in your relationship with the lender, as they likely want to exit the lending relationship. A company can improve its chances of success in […]

Blog

Advantages and Disadvantages of Non Recourse Factoring

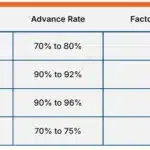

Non-recourse invoice factoring plans have quickly become very popular with Canadian companies that are looking for a factoring plan. The main advantage of non-recourse plans is that the factoring company absorbs the loss of advance, if your customer does not pay due to a credit reason. Factoring companies use different rules to define what is a qualifying ‘credit […]

What is Non-Recourse Factoring?

Non-recourse factoring is a type factoring financing in which the factoring company assumes the loss if invoices are not paid due to end customer insolvency. It is one of the two common types of invoice factoring offered by Canadian factoring companies. However, it is also widely misunderstood by clients. In this article, we discuss: 1. […]

Financing Sales to Big Box Retailers

Becoming a distributor for a large big box retailer – companies such as Walmart, Loblaws, or Rona- can be both a important opportunity and a major challenge at the same time. Most big retailers can place large purchase contracts, which are great for revenues. However, they also negotiate payment terms that enable them to pay your invoices […]

Financing your Imports from China and Asia

Resellers and distributors often have to play a very delicate game of balancing their cash flow. This can even be more challenging if you are buying goods from factories in China, or anywhere in Asia for that matter. On one hand, the Chinese factories will want you to pay for the goods in a secure […]

Executing Your Trucking Company Business Plan (6 Steps)

The most challenging step in starting a trucking company is often the first step – getting started. However, this step can be difficult for many first-time trucking entrepreneurs. Everyone knows that the best business plan is useless unless you put it into action and implement it. This article helps you take on the six most […]

Financing for Resellers and Distributors

For many resellers, distributors and importers, managing cash flow is a very important but delicate task. Unless you have a long established relationship with your supplier, they will likely ask you to prepay for goods – or pay upon shipment. On the other hand, your commercial clients will often demand to pay your invoices in […]

How Much Does Factoring Cost?

This article explains how to calculate the factoring fees of a factoring proposal. It covers the three most common proposal fee types: flat-rate, variable-rate, and discount-plus-margin. We cover the following: 1. How does factoring work? This article assumes that you are already familiar with factoring and know how it works. Here is a short summary […]

How Do Factoring Companies Buy Accounts Receivable?

One of the advantages of invoice factoring is that most transactions are not structured as loans. Instead, the client sells their accounts receivable to the factoring company in exchange for an immediate payment. This article describes how a company sells their invoices to a factor and covers the following subjects: 1. Factoring basics Invoice factoring […]

Advantages and Disadvantages of Purchase Order Financing

In recent years, purchase order (PO) financing has been gaining popularity as a tool to finance companies that have been awarded a large purchase order. In this article, we discuss: 1. What is purchase order financing? Purchase order financing helps distributors and resellers that need funds to fulfill large purchase orders. The solution helps pay […]