Summary: Running a freight brokerage requires careful management. As a broker, you are in the middle of a transaction, balancing the demands of your shippers and carriers. Aside from the obvious logistical problems, this situation can also create cash flow problems. This article discusses how to finance a growing freight brokerage and solve the most […]

How to Finance a Trucking Company

Every successful trucking company needs to use financing at some point. Growing companies have to buy equipment, pay employees, and handle multiple expenses. Eventually, the owner will run out of funds and use external financing. This article discusses how trucking company owners can finance their two most significant expenses: equipment purchases and operations. It also […]

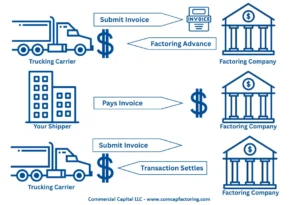

What is Freight Bill Factoring? How Does it Work?

Freight factoring, also known as freight bill factoring, is a form of business financing in the transportation industry. It helps carriers and brokers improve their cash flow by financing their invoices from slow-paying clients. Factoring provides companies with the funds to operate and grow to their full potential. We cover the following: 1. How does […]

How to Find Trucking Contracts

One of the greatest challenges for new owner-operators and small fleet owners is finding loads and long-term trucking contracts. Sadly, this is one of the most common reasons many small trucking companies go out of business. In this article, we cover the following: (Note: we do not provide trucking contracts. This article is provided for […]

Payroll Financing for Staffing Companies

Making payroll is the most critical task for any growing staffing agency. You can retain high-quality talent only if you offer good salaries, good jobs, and you pay on time. However, cash flow problems jeopardize your ability to pay employees on time and prevent your company from reaching its true potential. In this article, we […]

Construction Factoring vs. Factoring: Key Differences

Construction factoring is a specialized type of invoice factoring adapted to work in the construction industry. It is very similar to invoice factoring, though it has some key differences. This article covers the main differences between both programs. It helps construction subcontractors determine if construction factoring is right for them. Read “What is construction factoring? […]

How to Finance Your Business in Canada (10 Options)

This article covers the ten most effective ways to finance a small or growing company. We cover several options that can be used to finance a wide range of situations. What do you need the funds for? There are several options you can use to finance a business. Some products are flexible and can be […]

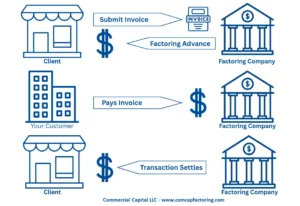

How Does Factoring Work?

Summary: Factoring is a type of financing that helps improve the cash flow of companies that have slow-paying invoices. This form of financing gives the client access to immediate funds, which can then be used to pay for business expenses and to grow. In this article, we show you how factoring works. We go over […]

What is Factoring?

Summary: Factoring is a form of financing that helps companies with cash flow problems due to slow-paying clients. It allows your business to finance invoices, which improves your company’s working capital. Factoring transactions are structured as the sale of accounts receivable rather than as a business loan. Consequently, they can be set up quickly and […]

Navigating Asset-Based Loans: Small Business Guide

Asset-based loans (ABLs) enable companies to get financing by leveraging their accounts receivable, inventory, and other assets. These loans are a popular option for Canadian companies due to their flexibility, simpler qualification requirements, and easier compliance. This guide helps business owners understand how ABLs work, which assets can be financed, what lenders look for, and […]