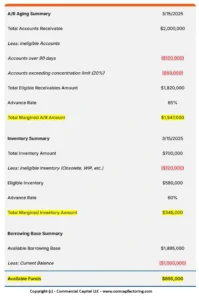

A borrowing base certificate is a document that a company uses to draw funds from its asset-based loan (ABL). The certificate is typically used in ABLs secured by accounts receivable since these loans are structured as revolving lines. This article explains how borrowing certificates work and covers the following: 1. What is a borrowing certificate? […]

Blog

Asset-Based Loan Qualification Requirements

Summary: Asset-based loans are commonly used by small and middle-market companies that need financing. Their main advantage is that they offer a flexible structure and support several types of collateral. Asset-based loans are popular with companies because these loans have fewer covenants and simpler qualification requirements than bank financing. Read “What is an Asset-Based Loan? […]

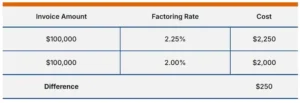

How to Compare Factoring Company Rates

Most people use a simple approach when comparing proposals from competing factoring companies. They make their decision based on who offers the lowest rate and the lowest application fee. While this strategy is common, it can lead to making a wrong decision. This is because the lowest rate does not always equal the lowest cost, […]

Financing for Utility Construction Companies

Undercapitalized utility construction companies can experience financial problems when they give payment terms to clients. These terms are often non-negotiable and allow clients to pay invoices in 30 to 60 days. This article discusses two solutions: invoice factoring and construction factoring. Both solutions can be used to finance slow-paying invoices and improve cash flow. We […]

How Does Fuel Advance Factoring Work?

Summary: A fuel advance is an add-on that many factoring companies offer alongside their freight bill factoring programs. Fuel advances provide funds to cover fuel and other expenses. Your company gets access to these funds when you pick up a load. Fuel advances are used by small and growing trucking companies that need funds to […]

Financing a Directional Boring / Directional Drilling Company

Managing the cash flow of a directional boring/directional drilling company can be challenging. Like most companies in construction, they face a common cash flow dilemma. The company has to pay expenses quickly but must also wait up to 60 days to get paid by clients. This situation can leave directional boring companies with a cash […]

Purchase Order Financing Cost and Rates

Summary: Purchase order financing is commonly used by small companies that have won a large purchase order but don’t have the financial means to fulfill it. This article discusses the average PO financing rates and how transactions are structured. This information will help you determine if PO financing is the right solution for you. The […]

Eight Advantages of Asset-Based Loans (ABLs)

Asset-based loans (ABLs) are used by small and middle-market businesses to improve liquidity and finance new projects. They offer similar advantages to conventional solutions. However, they are more flexible and have simpler qualification requirements. This article discusses the eight important benefits of asset-based loans. To learn more about asset-based loans, read “What is Asset-Based Lending?“ […]

Are Factoring Rates That Important?

Most prospective clients consider the factoring rate the most important feature of a plan. In fact, pricing is usually the first question clients ask prospective finance companies. Seeking the best rate is a good strategy, but it should not be the only detail you look for. Other parts of a plan are just as important. […]

Selling Accounts Receivable to Finance Your Business

Companies experience cash flow problems at one point or another. These issues are common in small companies and in companies that are growing quickly. Cash flow problems can usually be fixed using the correct type of financing. However, getting a bank loan or a line of credit remains out of reach for many small and […]