Summary: Purchase order financing helps companies finance their supplier costs and enables them to handle large orders. It has grown in popularity with Canadian resellers and distributors. This article explains how purchase order financing works, how much it costs, and how transactions are settled. It also provides a detailed example of a transaction. We cover the following:

- What is purchase order financing?

- How does it work?

- Transaction settlement

- Cost

- Sample transaction

- Should you use PO financing?

- Provincial differences

1. What is purchase order financing?

Winning a large order is a great opportunity for a small company only if you have the financial resources to fulfill it. Otherwise, the order becomes a problem because your options are limited. You can decline the order and lose the potential client. But, taking the order is riskier and could create cash flow problems. Neither option is good.

The main problem is simple. Your suppliers want a prepayment, but your clients want to pay you net-30 to net-60 terms. This creates a gap that you have to cover.

Purchase order financing helps you manage the financial gap by handling your supplier payment. It allows you to take on the order and pay your supplier so you can deliver the goods to your customer. Read “What is purchase order financing?” to learn more.

Note: Companies that manufacture or assemble goods directly should consider supplier financing instead.

2. How does it work?

Transactions are typically broken into four general parts. However, the details vary by transaction. More complex transactions may require additional steps to ensure they clear successfully.

Step 1: Supplier gets paid

Most suppliers require a prepayment, especially for large orders. The finance company can wire a payment to your supplier only if they are a large public company (e.g., Fortune 1000 companies) located in Canada or the US. Alternatively, your supplier will be paid with a Letter of Credit (LOC).

A LOC is a financial instrument that protects both parties in a transaction. It guarantees payment to the supplier as long as they meet the requirements of your order.

Step 2: Products manufactured and inspected

Once payment is received, your supplier will begin to fulfill your order. This process can be quick if they have the items in stock. It will take longer if they need to manufacture them.

The order will be inspected by a third-party inspection company (e.g. SGS) to ensure it complies with your specifications. The inspection is an essential part of the process, and it helps catch potential problems as early as possible.

Step 3: Product is delivered

Once the goods are inspected, they will be shipped and delivered to your customer. You can now invoice your client, who should pay you in net-30 to net-60 days.

Step 4: Transaction settles

The transaction settles once the PO financing company is paid. You can do this by waiting for the client to pay on their usual terms or by settling through a factoring line. Your financing needs and your transaction details should determine the option you use.

3. Transaction settlement

The simplest way to settle a transaction is to keep the PO financing line open until your customer pays. This allows the PO funding company to get paid for their services. The remaining funds are remitted to your bank account.

a) Using a factoring line

Business owners should consider using a factoring line to settle a transaction with a high gross margin. When used correctly, this can minmise your costs or be used to provide additional working capital. These benefits don’t apply to every transaction and should be examined individually.

4. Costs

The cost of a purchase order financing transaction varies based on the transaction’s size, risk, and duration. The average cost is 3% – 4% per 30 days. Transactions can be prorated to account for longer or shorter durations.

5. Sample transaction

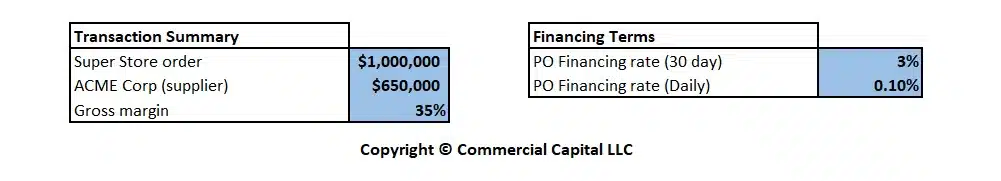

In this section, we showed a simplified transaction example. Assume that ABC Supplies Inc. is a small distributor of electronic products to large retailers. They purchase their goods from an overseas supplier called ACME Corp, which is based in an Asian country.

ABC Supplies gets a $1,000,000 CAD purchase order from Super Store, a major retailer. ABC Supplies secures a quote from ACME Corp to buy the products for $650,000 CAD. This transaction has a 40% gross margin and is very profitable.

ABC Supplies has one problem that is typical in these situations. ACME Corp wants to be prepaid for the goods. Unfortunately, ABC Supplies does not have the funds to cover the prepayment cost.

Consequently, ABC Supplies decides to use a purchase order financing facility. They are quoted a price of 3% per 30 days, prorated at 0.10% daily. Their gross margins can cover the expected cost, so ABC Supplies moves forward with the transaction.

a) Transaction flow

Day 1: ABC Supplies places an order with ACME Corp for $600,000 worth of electronics. ACME Corp requests a prepayment, so the purchase order financing company opens a Letter of Credit in favor of ACME Corp. The LOC, which was opened with a well-known bank, guarantees payment once ACME Corp fulfills the order.

Days 2- 23: ACME Corp sources all components and manufactures the electronic goods. This process takes a few weeks. By day 23, the order is ready for inspection.

Day 24 – 29: The goods are inspected by a third-party inspection company. The inspection company reviews the order, examines product samples, and ensures they work according to the specifications. The order passes inspection, and a certificate of inspection is issued.

Day 30: The supplier ships the goods to Canada using a 3PL company.

Day 60: The order arrives at Super Store’s warehouse and is accepted by their receiving department. ABC Supplies issues an invoice for $1,000,000 payable on Net-30 terms. ABC Supplies has decides to settle the transaction directly with the PO financing company.

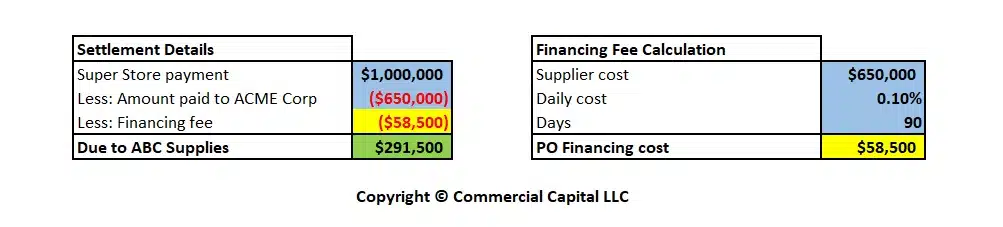

Day 90: Super Store pays the invoice by wire transfer. The transaction settles as follows:

- Invoice amount: $1,000,000

- Supplier payment: $650,000

- Financing fee: $58,500

- Total due to client: $291,500

The financing fee is calculated by multiplying the percentage, the number of days, and supplier cost. In this case, it is $650,000 x 90 days x 0.10% per day = $58,500.

The following table shows the transaction details and how they were calculated.

Note that this example has been simplified to illustrate how the product works. A similar transaction using factoring to settle the line would have a different settlement process.

6. Should you use PO financing?

You should always consult a financial professional if you are unsure if purchase order financing fits your transaction well. In our experience, purchase order financing works well if the following are true:

- Transaction’s gross margin exceeds 30%

- Your product has a broad market

- You are familiar with the product vendor

- Transaction is open for less than 100 days

7. Provincial differences

Purchase order financing is generally available to companies in all provinces. However, few companies have the capability to work with companies based in Quebec.

This is due to the differences in how collateral is secured. Collateral in Quebec is secured with a Hypothèque instead of PPSAs. Hypothèque have different legal requirements than PPSA and require specialised knowledge. Companies based in Quebec should evaluate their funding partners carefully to ensure they have experience working in the province.

Get more information

Are you looking for purchase order financing? We are a leading finance company in Canada and can provide you with a competitive quote. For information, get an online quote or call (877) 300 3258.