Summary: A factoring company provides financing to companies that have cash flow problems due to slow-paying invoices. Factors purchase accounts receivable from their clients at a small discount. The client gets immediate funds from the sale of their receivables, which solves their financial problems. The factor, who now holds the receivables, waits until the invoices […]

Factoring

The Truth About Cheap Invoice Factoring

Finding a company that offers good factoring rates can be difficult. Several companies advertise seemingly cheap factoring rates. However, these rates often look “too good to be true.” In many cases, these factoring plans appear cheap but become very expensive once you read the fine print. Finance companies are in a very competitive environment. There […]

Can I Sell My Invoices to Improve My Cash Flow?

Small business owners are often challenged when a large customer requests 30 to 90 days of credit to pay an invoice. As a business owner, you want to offer credit terms because it improves your ability to sell to large clients. However, offering credit terms can also hurt your company if you don’t have financial […]

How to Choose the Best Factoring Company

Selecting a factoring company is one of the most important financial decisions that you will make for your business. This article explains everything you need to know so you can find and select the best factoring company for your business. We cover the following: What is a factoring company? How does factoring work? Recourse vs […]

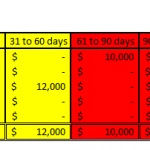

Accounts Receivable Aging Reports and Factoring

The accounts receivable aging report is one of the most important reports that a factoring company asks for when processing your application. The factoring company uses this aging report to determine the size and quality of your invoice portfolio. It helps determine which terms – such as invoice factoring rates and factoring advances – will […]

How Does the Factoring Advance Affect Your Cost?

When business owners negotiate with factoring companies, they usually focus on negotiating the best factoring rate. However, owners often don’t consider that the factoring rate is not the same as the factoring cost – at least, not on a “per-dollar” basis. The factoring cost has two major components: the rate and the advance. Getting the […]

Recourse vs. Non-Recourse Factoring

There are two types of factoring financing, commonly known as recourse and non-recourse factoring. Some factoring companies specialize in one type of solution, though many companies offer both. In this article, we explain and compare both types of factoring. The article covers the following: How does factoring work? What is full recourse factoring? What is […]

How to Use Invoice Financing to Offer Credit Terms

Waiting 30, 45, or even 60 days to get an invoice paid is a challenge for many business owners. Small companies often have to wait for payment because their commercial sales are made on credit. This type of trade credit is commonly known as “payment terms.” Companies must offer payment terms because their clients demand […]

How to Handle a Business Cash Shortage with Factoring

Summary: Most companies have a cash shortage at one time or another. Cash shortages often happen to companies that add customers quickly and outgrow its cash reserve. Cash shortages can lead to further problems if not fixed correctly. This article provides practical strategies to prevent cash shortages. It also explains how to handle a cash […]

How Can Factoring Companies Help You?

Summary: Invoice factoring, an alternative source of business funding, is a popular way to finance small companies. It solves four key problems: It can improve your cash flow It can enable you to provide payment terms to your clients It provides a stable platform that can be used for growth It is available to small […]