Merchant cash advances are a popular but very expensive form of business financing. Companies that have excessive cash advance debt often look to refinance (or consolidate) these loans to escape from their high weekly cost.

In this article, we take you through a merchant cash advance refinancing transaction and discuss why merchant cash advances are not a good refinance option. We show you all transaction details and our calculations (hint: they are easy) so you can apply them to your own situation. In the conclusion, we provide alternatives that allow you to refinance expensive cash advances with market-rate loans.

1. How does a merchant cash advance work?

Cash advances are very simple to understand. The lender provides you with funding and then debits your bank account until they are paid off.

The key figures in their proposal are the advance amount, the factor rate, and the repayment period. You use these figures to calculate the total payment amount and your weekly payment. These figures also allow you to calculate the lender’s profit. This last number is very important, as it gives you an idea of the cost of these loans.

Some basic definitions:

- Advance: The funding amount that your company gets

- Factor rate: The multiple used to calculate total payment

- Repayment period: Number of weeks (or months) needed to pay back the lender.

- Total payment : The total amount of money you will pay the lender

- Weekly payment: The weekly payment amount

- Lender’s profit: The amount of money exceeding the initial advance amount

If you need more details, read “How Does a Cash Advance Work?”

Let’s look at an example based on current market rates:

Lender A

- Advance: $250,000

- Factor rate: 1.35

- Repayment period: 36 weeks (9 Months)

With this information, we can calculate your total payment, weekly payment, and lender’s profit. They are as follows:

- Total payment: $337,500 ($250,000 x 1.35)

- Weekly payment: $9,375 ($337,500 / 36 weeks)

- Lenders profit: $137,500 ($337,500 – $200,000)

Calculating these numbers is simple. We used these formulas:

- Total payment = Advance x Factor rate

- Weekly payment = Total payment / Number of weeks

- Lender’s profit = Total payment – Advance

2. You still pay the total payment even when you pay early.

Conventional business loans are amortized using compound interest. This process keeps track of interest and principal in separate categories. The weekly payment is used to pay interest and lower the principal’s balance. Consequently, the principal decreases as you pay off the loan.

Paying off the loan early saves you money because you pay only the remaining principal. You don’t have to pay off any “unearned interest.” In most cases, there is a benefit if you pay off the loan early. Note: This description has been simplified. Some loans have early payment penalties.

Merchant cash advances are different. There is no interest and principal as in an amortized business loan. You owe a fixed amount. Each payment reduces the amount you owe.

However, you can close the loan only by paying off the remaining outstanding balance. You don’t get any savings from paying early. The last point is very important. Paying off Lender A’s cash advance early only accelerates their $137,500 profit. This has negative implications if you want to refinance the MCA with a new cash advance.

3. Refinancing with a new cash advance

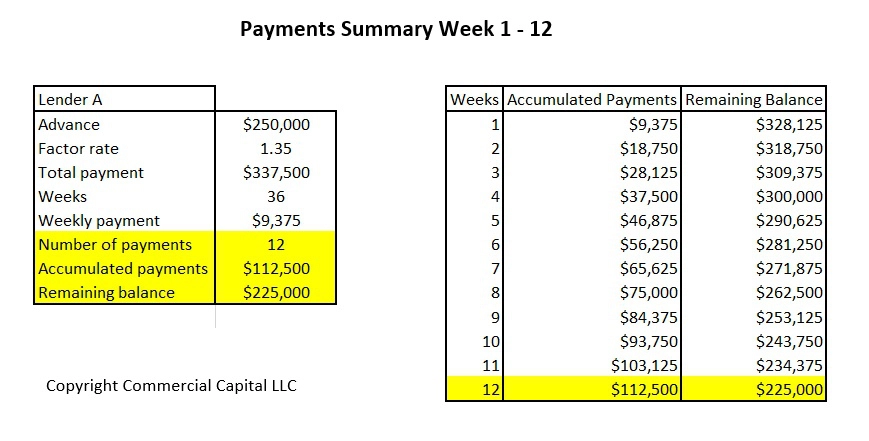

Let’s assume a business gets the cash advance from Lender A using the terms we discussed previously. The business makes weekly payments for 12 weeks and then determines it can’t afford the $9,375 weekly payment. Let’s examine the situation. Lender A offered these terms:

Lender A

- Advance: $250,000

- Factor rate: 1.35

- Total payment: $337,500

- Repayment period: 36 weeks (9 months)

- Weekly payment: $9,375

After 12 weeks of payments, the cash advance looks as follows:

- Payments for 12 weeks: $112,500 ($9,375 x 12 weeks)

- Remaining balance: $225,000 ($337,500 – $112,500)

The following tables provide a more detailed view of the transaction so far:

After some research, the business owner finds Lender B. Lender B apparently offers better terms. They offer:

Lender B

- Advance: $225,000 (just enough to close the loan from Lender A)

- Factor rate: 1.4 (higher rate due to risk)

- Total payment: $315,000

- Repayment period: 56 weeks (14 months)

- Weekly payment: $5,625

The new cash advance covers only the $225,000 payoff balance for Lender A. The objective is to refinance the merchant cash advance from Lender A.

The new cash advance has a longer payment term of 56 weeks but a higher factor rate due to the risk. The owner’s weekly payment reduces to $5,625 because the repayment period is longer.

The owner considers Lender B’s weekly payment to be manageable. Therefore, they proceed to refinance the cash advance from Lender A with the cash advance from Lender B. This pays off lender A and leaves the business owner with only the cash advance from Lender B. Note that the cash advance from lender B provides no new cash to the business.

Lender A gets a great deal because they got the full payment of $337,500 early. They got $112,500 from 12 weeks of payments and $225,000 from payoff.

Some would say that the business owner got a good deal too. Their company just lowered their weekly payments from $9,375 to $5,625. Arguably, that’s a big decrease. Isn’t that great?

4. Was it a good deal? We don’t think so.

Let’s look at the costs of the transaction and determine if it was a good deal:

- Lender A’s total payment: $337,500

- Lender B’s total payment: $315,000

- Total lender payments: $625,500 ($337,500 + $315,000)

In other words, the business owner paid $625,500 to get access to $250,000 for about a year and a half. You can be the judge regarding how good a deal that is.

Some would argue that the previous logic is wrong. Instead, they argue that the business owner had access to $475,000 ($250,000 + $225,000) from both cash advances. Refinancing was just the owner’s business decision. The business owner could have used the second cash advance for other purposes.

While “mathematically accurate,” the previous argument neglects the financial reality of the situation. Having two open advances at the same time is prohibitively expensive. It is also financially dangerous.

To keep both advances open, the business owner must pay $9,375 to Lender A and $5,625 to Lender B every week. That is a total of $15,000 every week both loans are open. And, if you recall, the only objective for getting the second cash advance was to lower the monthly payments.

Having multiple cash advances open at the same time is called “stacking.” Financial experts recommend against stacking. We agree with their recommendation.

5. Why is this transaction so expensive?

Refinancing a cash advance with another one is very expensive for one simple reason. The business owner paid a full price of $315,000 for the $225,000 advance from Lender B. However, the $225,000 advance itself is a combination of principal and interest fees that was already owed to Lender A.

Basically, the business owner is paying interest twice for some of the money they borrowed. They are also paying interest to “pay off Lender A’s interest.” The combination of paying for some money twice and paying high “interest on interest” costs makes using a cash advance to refinance a MCA prohibitively expensive.

6. Is there a smarter alternative?

If you need to refinance a cash advance, the smarter alternative is to use an SBA-backed loan. If you cannot get an SBA-backed loan, consider a conventional bank loan or a loan from lending institution. Some business owners are averse to SBA-backed loans because of their complicated application process.

Don’t let that deter you. The savings in financing costs are usually more than worth it. Learn more about how to consolidate merchant cash advances with a loan.

7. Will you qualify for a debt consolidation loan?

Qualifying for a loan is easier than most people think. However, it does require some effort. The owner and the company have to meet some basic criteria. They must have:

- A minimum debt of $500,000

- At least 3 years in business

- Equipment and/or real estate

- Up-to-date taxes (or a payment plan in place)

- Reasonable personal credit

- A profitable company (or one that would be profitable with better debt)

Learn more about qualifying for business refinancing.

Looking to refinance your cash advance?

For information about our business debt refinancing and consolidation program please don’t call the number above. Instead, fill out this form – a specialized agent will contact you.