Summary: Purchase order financing helps small businesses that have a large order and need funds to pay their vendors. It helps cover your supplier expense, enabling you to fulfill the order and book the revenue.

While this solution is flexible, it works only with specific transactions. This article explains how PO financing works, who it helps, and how transactions are settled. We cover the following:

- What is PO financing?

- Does your purchase order qualify?

- How does purchase order financing work?

- Should you use factoring to settle transactions?

- PO Financing advantages

- PO Funding limitations

- Detailed example

1. What is purchase order financing?

Getting a large order can be a growth opportunity for small resellers. However, a large order can become a problem if your suppliers demand a pre-payment and your company lacks the funds to pay.

This is a common problem for small businesses. Consequently, they miss larger opportunities, and their revenues suffer.

A purchase order financing program helps close the financial gap between paying your suppliers and receiving payment from your clients. It handles your supplier payment, enabling you to fulfill the order and book the revenue. When used strategically, PO funding can help your business grow.

2. Does your purchase order qualify?

Purchase order financing has simple qualification criteria. However, it can be used only on certain types of transactions.

a) Product sales only

The order must be for a physical product only. The products must be bought from your supplier as a finished good. It must then be sold to commercial clients without any modifications or assembly. Purchase order funding is typically used by distributors, resellers, and government vendors.

Note that companies that manufacture or assemble goods can consider supplier financing.

b) Single supplier

This solution works best if your order requires buying products from a single supplier. It can work in transactions with multiple suppliers if the transaction meets some additional requirements (e.g., partial deliveries allowed, etc.)

c) Gross margins over 30%

Purchase order funding works best for transactions with gross margins that exceed 30%. It can work with transactions with gross margins as low as 20%, but it is not ideal, and your company may need to contribute some funds to the transaction.

d) Commercial or government sales

This solution can be used only for sales to commercial clients or government agencies in the USA or Canada. It cannot be used for transactions where the customer is overseas.

e) Must meet minimum order size

Each individual order you want to finance must be for at least $100,000. Unfortunately, we are unable to finance smaller orders. This is due to the amount of work processing and managing each order requires.

f) No Consignment or “Guaranteed Sales”

Purchase order financing cannot be used on so-called “guaranteed sales.” The term “guaranteed sale” is typically misunderstood by small business owners. It allows buyers – your clients – to return any unsold product for a refund.

3. How does PO funding work?

Most purchase order financing transactions have the following six steps. However, the initial application process in Step 1 is only required once to create an account.

Step 1: Submit an application and information

The first step in the process is to submit an application and supporting transaction documentation to the finance company. Each finance company has its own requirements, but most usually ask for the following:

- Copy of purchase order

- Supplier information

- Backup documentation showing a previous similar transaction

- Accounts payable / accounts receivable report

If the transaction is approved, a contract is executed, and the process to get funding starts.

Step 2: Supplier payment

The financing company pays your supplier through an approved method. Large and well-established suppliers within the USA or Canada that meet the finance company’s risk criteria may be paid by wire. All others will be paid using a letter of credit.

A letter of credit guarantees their payment, provided they meet the pre-agreed quality and delivery criteria. Note that all foreign suppliers are paid with a letter of credit or similar instrument. They cannot be prepaid using a wire transfer.

Step 3: Inspection

In most cases, the goods will be inspected by a third-party inspection company such as SGS. The inspection helps ensure that the goods produced by the supplier meet the purchase order specifications. Inspections are typically performed before the goods are shipped.

Step 4: Product delivered to the end-customer

After inspection, the goods are shipped to the end customer. In most cases, the end customer performs their own inspection to confirm the goods meet the purchase order’s requirements.

Step 5: Invoice sent to end-customer

At this point, you can send an invoice to the customer. You have fulfilled your obligations to the customer and must wait for payment. Most business and government clients pay their invoices on Net-30 terms.

Step 6: Transaction settlement

Transactions have two ways of settling. The option you use depends on your financial requirements and the transaction’s details.

The simplest settlement option is through the purchase order financing company. Settlement happens once the PO financing company gets the payment from your end customer. This allows them to deduct any supplier payments and fees. All remaining funds are remitted to your company.

Alternatively, you may choose to factor the invoice. You can use the factoring advance to settle with the PO Financing company. From that point forward, the transaction works like a conventional factoring transaction.

4. Should you use factoring to settle transactions?

Sometimes, settling a purchase order financing transaction with factoring can lower your total costs, provide additional working capital, or both. These benefits vary based on transaction details, so they must be determined for every transaction. Furthermore, factoring does not help every transaction.

Read “How does factoring work?” to learn more.

a) Additional cash flow

Transactions with very high margins can benefit from factoring if your company needs the additional cash infusion you’d get at settlement. The amount of cash you’d get at settlement is determined by the difference between the PO financing settlement cost and the factoring advance.

b) Lower total costs

In many transactions, the cost per dollar of factoring is lower than the cost per dollar for purchase order financing. Settling using a factoring line will lower your total transaction cost in these transactions.

5. PO Financing advantages

Purchase order financing has several advantages that can help small and growing distributors and resellers. The most important advantages include the following.

a) It allows small businesses to take on large orders

The most important advantage of purchase order financing is that it enables small companies to fulfill large orders. This unlocks new opportunities and allows you to grow the company past its original capital limitations.

b) The line grows with your business

The size of the line is determined by the credit quality of your end customers, your supplier’s capabilities, and your ability to execute an order. This flexibility is unparalleled by conventional financing products.

c) Simpler qualification criteria

PO financing lines have simpler qualification criteria than other financing products. Furthermore, this solution is available to companies with a short track record.

6. PO Funding limitations

This solution also has some limitations that must be considered. These include the following.

a) It’s comparatively expensive

The cost of PO financing varies based on the transaction’s risk profile and volume. However, the average 30-day cost ranges from 3% to 3.5% of the supplier cost. These costs are prorated and accrue until the PO financing company is paid.

b) Only covers direct supplier expenses

The line only covers the direct supplier expense for the order. Furthermore, the finance company pays the supplier directly.

c) Works only with high-margin transactions

Purchase order funding works only on transactions that have high margins. In general, transactions with margins higher than 30% work best.

7. Purchase order financing example

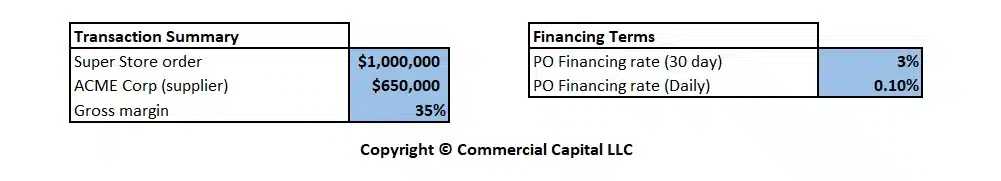

ABC Supplies is a small business that wins a $1,000,000 purchase order for electronic products from Super Store, a major retailer. ABC Supplies gets a quote to buy the products from ACME Corp, an overseas supplier. ACME Corp quotes $650,000 for the order, which provides ABC Suppliers with a 35% gross margin.

There is one problem. ABC Suppliers does not have enough funds to pay ACME. They decide to work with a purchase order financing company to help finance the transaction.

a) ABC Supplies uses PO Financing

ABC Supplies works with a PO financing company that offers to cover the supplier cost of the transaction. The finance company charges 3% per 30 days and offers pro-rated daily terms at 0.10%. After careful review, ABC Supplies determines that their profit margin is sufficient to cover the finance expense and still make a decent profit. They decide to move forward with financing.

b) Transaction details

The transaction starts when the PO financing company opens a Letter of Credit (LoC) to benefit the overseas supplier. It guarantees the supplier’s payment if they fulfill the order’s requirements. The transaction then proceeds as follows:

- ACME Corp begins the manufacturing process

- Goods are manufactured in 60 days.

- Goods are inspected by 3rd party company

- ACME Corp ships the goods to the US

- ABC Supplies sends invoice to Super Store for $1,000,000

- Supper Store pays $1,000,000 after 30 days

- The finance company settles the transaction

c) Transaction settlement

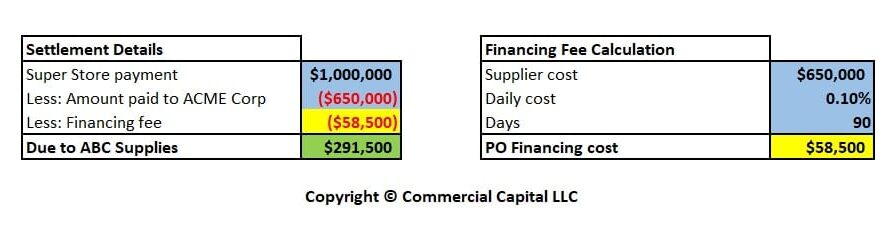

The transaction lasted 90 days. It took 60 days to manufacture and ship the goods and 30 days to get paid. The fee was set at 3% per 30 days. Consequently, the cost is 0.10% x 90 days x $650,000, totaling $58,500. The following chart explains the transaction in more detail.

The PO financing company settles the transaction by deducting the $650,000 supplier payment and the $58,500 fee from the $1,000,000 payment. The remaining $291,500 is forwarded to the client.

Note: This transaction has been simplified for illustrative purposes. It also settles through the PO financing line rather than using factoring.

Get more information

We are a leading purchase order financing company and can provide competitive rates. For information, get a quote or call (877) 300 3258.

Disclaimer: This article is for information purposes only and does not intend to provide legal or financial advice. Please get competent advice from a CPA or attorney if you require it.