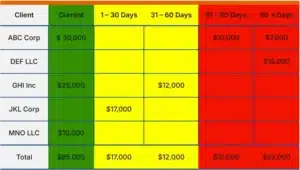

The accounts receivable aging report is one of the most important reports that a factoring company asks for when processing your application. The factoring company uses this aging report to determine the size and quality of your invoice portfolio. It helps determine which terms – such as invoice factoring rates and factoring advances – will […]

Blog

Factoring Application Mistakes to Avoid

Four common application mistakes can lead to a funding delay or a rejection of your factoring application. This article provides suggestions to avoid these mistakes and improve your chances of getting funding. Lastly, we provide a strategy to handle transactions in which the company (or owner) has negative information. Mistake #1 – Hard-to-read applications Submitting […]

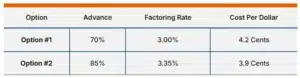

How Does the Factoring Advance Affect Your Cost?

When business owners negotiate with factoring companies, they usually focus on negotiating the best factoring rate. However, owners often don’t consider that the factoring rate is not the same as the factoring cost – at least, not on a “per-dollar” basis. The factoring cost has two major components: the rate and the advance. Getting the […]

How to Get the Best Factoring Rates

Most companies looking for factoring try to get the best rate by sending applications to as many factors as possible. While this approach can work, having many open applications is hard to manage. Ultimately, the process is time-consuming and doesn’t always work. Fortunately, there is a better way to get the best factoring rates. It […]

Recourse vs. Non-Recourse Factoring

There are two types of factoring financing, commonly known as recourse and non-recourse factoring. Some factoring companies specialize in one type of solution, though many companies offer both. In this article, we explain and compare both types of factoring. The article covers the following: 1. How does invoice factoring work? Before discussing the specifics of […]

Financing a Fluid-Hauling and Saltwater Disposal Company with Factoring

Every barrel of oil generates several barrels of produced water (i.e., brine) and flowback. These liquids are environmentally dangerous due to their high concentration of salt, organic compounds, and chemicals. Consequently, they must be disposed of properly. There is a large demand to haul and dispose of production fluids from wells. Companies in this segment […]

Invoice Factoring For School Bus Companies

Most public schools provide bus service to students who live in the area. In most cases, these buses are owned by subcontractor owner-operators and not the local school district. A school bus contract can be a major benefit for a bus company because it provides reliable revenue to the company during the school year. However, it […]

Invoice Financing for Oilfield Service Companies

The oil and gas industry is known for being somewhat unpredictable. Demand for products and services can change quickly with little if any notice. Actually, sudden increases or increases in supply and demand are not uncommon. These drastic changes create financial hardships for small oilfield service companies. This article discusses three strategies to help improve […]

Factoring for Oilfield Transportation Companies

Summary: Oilfield transportation companies handle some of the most difficult loads in the transportation industry: heavy haul, oversized, chemicals, and specialized fluids. Additionally, companies often provide storage facilities as part of the services. The complexity of their services makes oilfield transportation companies difficult to operate. Managing the company’s cash flow can be as challenging as […]

Freight Financing for Trucking Companies

Most trucking companies are started by drivers who invest their own money to launch and grow the company. While many drivers have a great deal of industry experience, they don’t always have a lot of money. Often, this situation prevents them from reaching their full potential. It also leaves them open to cash flow problems. […]