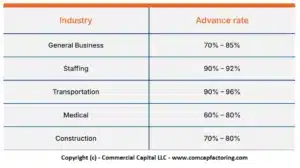

Most clients are initially perplexed to hear that the factoring advance, which is paid as soon as the invoice is sent to the factoring company, is less than the full value of the invoice. Most factoring companies advance between 70% and 90% as a first installment and hold 10% to 30% of the invoice as […]

Blog

How to Finance a Pallet Manufacturing and Distribution Company

Running a pallet manufacturing and distribution company can be challenging. You have to manage the logistics of your supply and vendor chain while tracking your customer orders – all while keeping an eye on your cash flow to make sure you can keep the business running. Managing cash flow can be tricky, especially for companies without big capital reserves. […]

How to Finance a Machining and Metalworking Company

Summary: Most industrial and commercial clients pay invoices on net-30 terms. However, offering net-30 terms can create cash flow problems for machining companies that aren’t well capitalized. This article shows how you can solve this problem by improving operations and financing your invoices. We cover the following: 1. Are you offering payment terms? One of […]

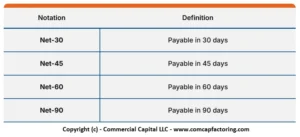

What Are Net-30 Terms? How Do They Work?

Summary: Most commercial transactions use payment terms, typically referred to as offering “Net 30 – 60 days.” These terms are a form of credit that typically gives clients 30 to 60 days to pay an invoice. Companies must offer payment terms if they want to remain competitive, especially when bidding for large opportunities. However, offering […]

Financing Alternative for Construction Subcontractors

Most construction subcontractors experience financial problems at one time or another. The industry is known for working with tight cash flows. This situation can create serious challenges for business owners and affect their ability to run and grow their companies. In this article, we discuss alternatives to solve this problem once and for all. We […]

How Purchase Order Financing Can Help Resellers and Wholesalers

Most wholesalers and resellers have a relatively simple business model: they buy goods from suppliers (local or foreign) and resell them at a markup to corporate clients. Although the business model may be simple, running this type of a business is not easy. Managing the cash flow can be difficult, which can limit your ability to […]

Financing An Import Business with Purchase Order Funding

Product importers are accustomed to dealing with long, grueling cash flow cycles. On one hand, foreign suppliers often demand prepayment before manufacturing and shipping an order. This requirement is often non-negotiable. However, prepaying suppliers often ties your funds for 30 to 60 days, depending on their manufacturing schedules and shipping time frames. On the other hand, if […]

Can Purchase Order Financing Help You Grow Your Business to the Next Level?

One of the biggest obstacles to growth for successful resellers and importers is the lack of working capital. Most small business owners start companies by investing their own money. In most cases, the initial contribution is sufficient to start the company and take in a few orders. But soon, the company starts growing. Since small companies seldom have the […]

How to Use Purchase Order Financing For Fast Business Growth

There is a feeling of exhilaration that every entrepreneur gets when their company lands a large client – the type of client that could lead to explosive growth. But soon, reality sets in. You start wondering if your company has the capabilities and the financial resources to execute on the order. If it doesn’t, this […]

Financing Growth: Freight Factoring for Trucking

Summary: Managing a growing freight carrier is difficult, especially while growing a fleet and adding drivers. While business growth is beneficial, it can also create cash flow problems. This article discusses how fast-growing carriers can use factoring to improve cash flow. You will be able to determine if it is the right solution to help […]