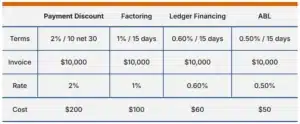

An early payment discount is an incentive that companies receive from suppliers in exchange for a quick payment. It is usually offered by suppliers that need to improve their cash position. In this article, we discuss: 1. Why do you need early payment discounts? Selling to commercial clients can be a challenge for small and […]

Frequently Asked Questions

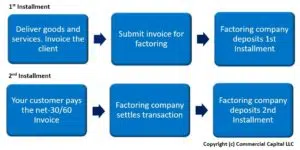

How Does Factoring Work?

Summary: Factoring is a type of financing that helps improve the cash flow of companies that have slow-paying invoices. This form of financing gives the client access to immediate funds, which can then be used to pay for business expenses and to grow. In this article, we show you how factoring works. We go over […]

What is Non-Notification Factoring?

Non-notification factoring is a form of receivables factoring that minimizes interactions between the factoring company and your customers. It avoids most concerns associated with factoring and enables clients to operate with fewer restrictions. In this article, we cover: 1. What is non-notification factoring? One of the main concerns clients have with factoring is that it […]

How Quickly Can Invoice Factoring Companies Provide Financing?

One advantage of factoring over other options is that many finance companies can get you funding quickly, usually within days. However, several things can delay the transaction. This article explains the factor’s onboarding process, potential transaction challenges, and how to streamline your funding process. We cover: 1. Overview of the process The onboarding process to […]

Why Must My Customer Send My Payments to the Factoring Company?

One of the chief objections that clients have with using factoring is that their customers need to remit payments to a new address. Actually, notifying the customer of the new payment address and procedure is a standard practice in the industry. Factors use a document commonly known as a notice of assignment. But why is […]

Common Problems When Factoring Invoices

Invoice factoring is commonly used by small and midsized businesses to improve their cash flow. Companies get funds by sending regular funding requests to the finance company. This article covers seven problems that can affect funding requests. It explains what causes the problem, discusses possible solutions, and describes how to avoid the situation in the […]

How to Check Your Client’s Business Credit (Commercial Credit)

Most companies that sell products or services to commercial customers have to offer payment terms – the option to pay invoices in net 30 to net 60 days. Many customers will do business with you only if you are willing to offer these terms. The problem is that not every company is creditworthy and deserving […]

Is Switching Factoring Companies the Right Choice for You?

The decision to change factoring companies should be made only after carefully evaluating the pros and cons. Many business owners underestimate the potential complexity of switching finance companies. This oversight can lead to problems that could have been avoided with proper planning. This article explains how the process works, common reasons for changing finance companies, […]

How to Deal with Slow-Paying Customers

Dealing with slow-paying customers can be a major headache for business owners. This is a bigger challenge for small companies that don’t have employees dedicated to collections. Ultimately, slow-paying customers affect your cash flow and distract you from running the business. Improving your invoicing and collections is not difficult, but it takes some discipline. The […]

How to Get the Best Factoring Rates

Most companies looking for factoring try to get the best rate by sending applications to as many factors as possible. While this approach can work, having many open applications is hard to manage. Ultimately, the process is time-consuming and doesn’t always work. Fortunately, there is a better way to get the best factoring rates. It […]