Many business owners complain of cash flow problems. However, a few companies actually have the opposite situation. They have excellent cash flow. In fact, they have more cash than they need to run their everyday operations. This scenario provides a great opportunity to increase profits. Companies with excess cash flow can use it to increase […]

Blog

Factoring Financing for Small Freight Carriers

Most small freight carriers don’t have adequate cash reserves. This situation is common for small businesses. Unfortunately, this lack of a reserve leaves them vulnerable to cash flow problems. Managing these cash flow problems is difficult because smaller trucking companies usually don’t have easy access to bank financing. This article discusses how small carriers can […]

Quick Pays vs. Factoring? Which One Works Better?

When it comes to dealing with slow-paying shippers, trucking carriers have two options: quick pays and factoring. This article helps you understand both options and covers the best strategy for using them. We discuss: 1. Slow cash flow is a problem Slow cash flow is one of the biggest problems for trucking carriers, especially new […]

Financing a Promotional Products Company

The promotional products market is highly competitive. Small promotional companies can’t often get the benefits of scale that come from fulfilling very large orders. Part of the problem is that they often lack the financial resources to compete for large orders. This could be due to ongoing cash flow problems or a lack of financing. […]

Financing a Call Center Using Invoice Factoring

Many companies consider call centers an essential but expensive aspect of their sales and customer service strategy. However, operating a call center in this highly competitive industry is challenging. Call center operators can easily experience cash flow problems, especially if they are new or growing quickly. This article discusses how to effectively solve the most […]

Advantages of Factoring your Freight Bills

Factoring is a form of financing that allows you to finance your slow-paying invoices. It improves your company’s financial position, providing the funds it needs to operate and grow. Learn more by reading “What is freight bill factoring?” This article highlights the advantages of freight bill factoring. It helps you determine if it is the […]

Advantages and Disadvantages of Purchase Order Financing

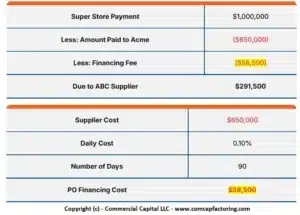

In recent years, purchase order (PO) financing has been gaining popularity as a tool to finance companies that have been awarded a large purchase order. In this article, we discuss: 1. What is purchase order financing? Purchase order financing helps distributors and resellers that need funds to fulfill large purchase orders. The solution helps pay […]

How to Deal with Slow-Paying Customers

Dealing with slow-paying customers can be a major headache for business owners. This is a bigger challenge for small companies that don’t have employees dedicated to collections. Ultimately, slow-paying customers affect your cash flow and distract you from running the business. Improving your invoicing and collections is not difficult, but it takes some discipline. The […]

How Does Purchase Order Financing Work?

Summary: Purchase order (PO) financing helps small businesses that have a large order and need funds to pay their vendors. It helps cover your supplier expense, enabling you to fulfill the order and book the revenue. While this solution is flexible, it works only with specific transactions. This article explains how PO financing works, who […]

How to Choose the Best Factoring Company

Selecting a factoring company is one of the most important financial decisions that you will make for your business. This article explains everything you need to know so you can find and select the best factoring company for your business. We cover the following: What is a factoring company? How does factoring work? Recourse vs […]