Many construction subcontractors have trouble paying employees or suppliers on time. Often, they have cash flow problems because clients pay invoices in 30 to 60 days while suppliers ask for quick payments. One way to fix this working capital problem is to use a revolving line of financing. This article explains how construction factoring can […]

Blog

What is Accounts Receivable Factoring?

Accounts receivable factoring is a type of business financing that helps companies with cash flow issues. It allows companies to finance their accounts receivable (A/R), which provides immediate funding. A/R factoring is commonly used by small and growing companies that don’t have large cash reserves. In this article, we cover: 1. Do you provide net-30 […]

What is Factoring?

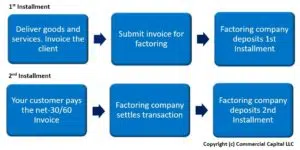

Summary: Factoring is a form of financing that helps companies with cash flow problems due to slow-paying clients. It allows your business to finance invoices, which improves your company’s working capital. Factoring transactions are structured as the sale of accounts receivable rather than as a business loan. Consequently, they can be set up quickly and […]

What is an Asset-Based Financing Line of Credit?

Summary: An asset-based line of credit is a specialized type of asset-based loan. It provides a revolving line of financing that must be secured by Accounts Receivable (A/R). Some lines can also finance Inventory as long as the A/R is included in the transaction. These lines are often used by small and mid-sized companies that […]

Invoice Factoring vs. Business Line of Credit

It’s not unusual for small and midsize businesses to experience cash flow problems from time to time. As a matter of fact, many growing companies encounter financial problems due to their fast growth. The most effective way to solve their cash flow problems is to use financing. The two most common financing solutions that help […]

Advantages of Sales Ledger Financing

Sales ledger financing is gaining traction as a financing option for mid-sized companies that are in good financial shape and are growing quickly. This solution is offered to companies that have outgrown conventional invoice factoring but are not able to meet the qualification requirements of a line of credit. Sales ledger financing offers a number of advantages to businesses, […]

Invoice Factoring vs. Sales Ledger Financing

Every company that is growing and doing well eventually experiences cash flow problems. Actually, the most common cash flow problem happens because customers pay invoices in 30 to 60 days. Companies can afford to offer terms and wait for payment – at least initially. But if your company is growing quickly, it will eventually run low on cash. […]

Advantages and Disadvantages of Payroll Financing

Payroll financing has been gaining traction as an effective way to provide funding to companies that need working capital to pay their employees. Companies with large payrolls often experience cash flow problems because of slow-paying clients. When this happens, the company must pay employees out of its own cash reserves. If the company is growing quickly, cash […]

Payroll Funding for Small Businesses

One of the greatest challenges that a small business owner can ever face is not having enough money to pay employees. Delaying payroll affects employee morale and your ability to retain key individuals. This article discusses how to use payroll financing to meet payroll and keep the business growing. We cover: 1. The most common […]

Payroll Financing for Staffing Companies

Making payroll is the most critical task for any growing staffing agency. You can retain high-quality talent only if you offer good salaries, good jobs, and you pay on time. However, cash flow problems jeopardize your ability to pay employees on time and prevent your company from reaching its true potential. In this article, we […]