This article offers two examples of how invoice factoring transactions work. It helps you understand how the account is funded, how fees are charged, and how the transaction is settled. The article covers the following subjects:

- What is invoice factoring?

- How does invoice factoring work?

- How much can a factor advance your company?

- How much does invoice factoring cost?

- Examples (single and two installment transactions)

1. What is invoice factoring?

Factoring is a tool that helps companies that have cash flow problems due to slow-paying customers. These clients often pay their invoices in 30 to 60 days. Slow payments can create problems for companies that are new, growing quickly, or not well capitalized.

The factoring company purchases your receivables and provides an immediate payment for them. These funds enable you to pay employees and suppliers, and to grow the business. The factor holds the invoices it purchased until your customer pays. Once your customer pays, the transaction settles.

Most companies factor their receivables regularly, which provides them with ongoing, predictable cash flow. This stability helps business owners manage and grow their companies more effectively. To learn more, read “What is invoice factoring?”

2. How does factoring work?

The factoring process is relatively simple. The most common type of factoring transaction finances invoices in two installment payments. The initial installment covers around 85% (varies by industry) of the value of your invoices. It is deposited in your bank account as soon as the invoices are verified. The initial installment is also called the “advance.”

The remaining 15%, less the factoring fee, is deposited in your bank account after your clients pay their invoices. This second installment settles the transaction.

Transactions with small carriers in the transportation industry often use a single installment instead of two. In those cases, the carrier gets a single (“full”) advance covering 95% to 98% of the invoice value. The portion that is not advanced becomes the factor’s fee.

3. How much can a factor advance your company?

Advances vary by industry and transaction risk. Industries that have a higher risk of invoice discrepancies (e.g., construction) often have lower advances. This table gives you a good idea of common advances for each industry.

| Industry | Advance |

| Most Industries | 80% to 90% |

| Transportation | 90% to 98% |

| Staffing | 90% to 93% |

| Healthcare | Medical | 85% (net billable) |

| Construction | 65% to 80% (net of retainage) |

4. How much does factoring cost?

The factoring rate is based on your expected financing volume, the credit quality of your clients, and how long your invoices take to pay. On average, factoring rates range from 1.15% to 4.5% per 30 days. Rates are often quoted in 30-day increments for simplicity. They are actually prorated by smaller increments, so you pay only for the time that the invoice is outstanding.

Keep in mind that your actual cost of factoring, also known as the “cost per dollar,” is based on your combination of rate and advance. You can find more details here.

5. Examples

In this section, we provide two sample transactions that show how factoring works. The first example shows a two-installment transaction. These transactions are the most common in the factoring industry and apply to most companies. The second example shows a single installment (“full advance”) transaction. They are often used to finance small transportation carriers that work with reputable brokers/shippers.

a) Example 1: Speedy Business Services, Inc.

Speedy Business Services, Inc. provides business services to corporate and government clients. The company is profitable and has been growing for the past few years. Most of its clients pay their invoices in 30 to 45 days.

Growth has created cash flow problems. Clients pay slowly but Speedy Business Services must pay employees and suppliers every couple of weeks. Consequently, the company has decided to implement a factoring program.

After reviewing its financial situation, the company decides to factor its accounts receivables from ABC, Inc. ABC is their best customer and regularly pays its invoices in 30 to 35 days.

Step 1: Application, due diligence, and contract

Speedy Business Services, Inc. submits its application, along with some information, to the factoring company. The factor reviews the information and provides Speedy Business Services with a proposal that has the following terms:

- Advance: 85%

- Rate: 2% per 30 days (prorated every 10 days)

This transaction is structured as a two-installment transaction. The first installment (the advance) covers 85% of the invoice. The remaining funds, less the fee, are advanced as a second installment after the invoice is paid in full.

After reviewing the terms, Speedy Business Services signs a contract with the factor.

Step 2: Notification

The factoring company sends a Notice of Assignment (NOA) to ABC, Inc. This document advises ABC that payments to Speedy Business Services must be deposited in a specified account (or mailed to a specific address). The NOA is a standard process in the factoring industry and every factor uses it.

Once this step is completed, Speedy Business Services can begin financing its invoices to ABC.

Step 3: Invoice submission and verification (ongoing process)

Whenever Speedy Business Services needs funds, they submit the invoices they want to finance to the factor. This process varies by factoring company. Usually the client can upload its invoices via an online portal or send them by email.

For this example, let’s assume that Speedy Business Services submits a single $100,000 invoice due from ABC, Inc. to the factor. The factor processes the invoice and verifies it with ABC, Inc.

Step 4: Funding the 1st installment (ongoing process)

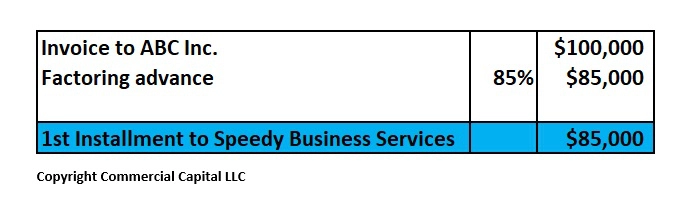

After the invoice has been verified, the factoring company deposits the 1st installment (the advance) in Speedy Business Services’ bank account. The advance is calculated by multiplying the invoice value by the advance rate: $100,000 x 85% = $85,000. The following figure illustrates this calculation.

Step 5: Settlement and funding the 2nd installment (ongoing process)

After ABC, Inc. pays the invoice, the factoring company settles the transaction. Once it has been settled, the factor remits the remaining funds to the client’s bank account.

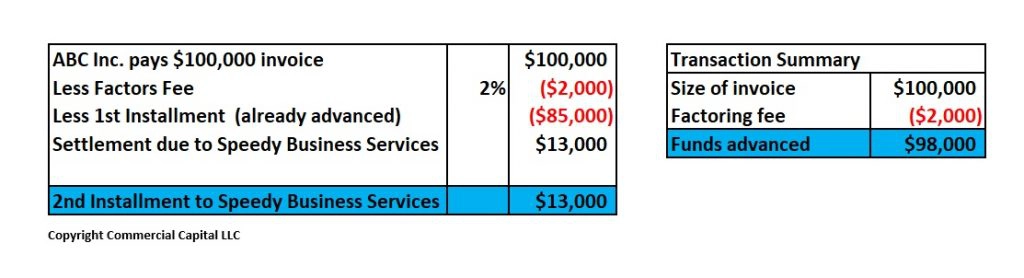

Let’s assume that ABC, Inc. pays the $100,000 invoice after 30 days exactly. The factoring fee for the invoice is obtained by multiplying the face value of the invoice by the factoring rate: $100,000 x 2% = $2,000 (2% is the fee for 30 days).

To settle the transaction, the factor subtracts the funds already advanced as a first installment and the factor’s fee from ABC’s payment: $100,000 – $2000 – $85,000 = $13,000. The remaining $13,000 is sent to Speedy Business Services as a 2nd installment. This payment settles this specific invoice.

b) Example #2: Speedy Carriers, LLC

This example shows a single-installment transaction. Speedy Carriers, LLC is a small and growing carrier. They pull reefer loads for a number of produce distributors.

The business has been growing steadily but is experiencing some cash flow challenges. Unfortunately, few of its customers quick-pay their invoices. Instead, customers pay their invoices in 30 to 45 days. This delay creates problems for Speedy Carriers when it is time to pay for drivers, fuel, or repairs.

To support growth, Speedy Carriers decides to factor some of its accounts receivable. After examining their books, they decide to factor their invoices to Delicious Produce. Delicious Produce is one of its largest clients.

Step 1: Application, due diligence, and contract

Speedy Carriers submits its application, along with its freight bills and other information, to the factoring company. The factor reviews the information and provides Speedy Carriers, LLC with the following proposed terms:

- Advance: 97.5%

- Rate: 2.5% (flat)

This transaction is structured as a single-installment transaction. Speedy Carriers gets a 97.5% advance and pays a flat fee of 2.5% for the service (97.5% + 2.5% = 100% of the invoice). The carrier agrees to these terms and executes a contract with the factor.

Step 2: Notification

Once the contract is executed; the factoring company sends a Notice of Assignment to Delicious Produce. The process is the same as the one described in the previous example. The NOA is standard in the factoring industry and advises Delicious Produce that payments due to Speedy Carriers must be deposited to a specified account (or mailed to a specified address).

After this step is completed, Speedy Carriers can begin financing its invoices to Delicious Produce.

Step 3: Invoice submission and verification (ongoing process)

Speedy Carriers decides to factor $30,000 of invoices to Delicious Produce. They submit the invoices to the factor via an online portal. This process varies by factoring company.

The factor verifies the invoices with Delicious Produce to ensure the amounts are accurate. After this step is completed, the factor is ready to fund the invoices. Speedy Carriers follows this process any time it needs to finance invoices.

Step 4: Funding only installment (ongoing process)

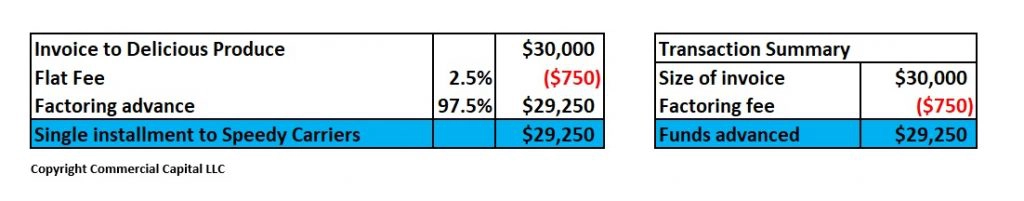

After the invoice has been verified, the factoring company deposits the advance in Speedy Carriers’ bank account. The advance is calculated by multiplying the invoice value by the advance: $30,000 x 97.5% = $29,250.

Step 5: Settlement – Transaction closes (ongoing process)

Once Delicious Produce pays the invoice, the factor settles the transaction. The factor collects its fee at that point. In our example, let’s assume that Delicious Produce pays the $30,000 invoice in 35 days. Speedy Carrier has a flat fee, thus the cost is the same regardless of when Delicious Produce pays. As shown in the following figure, the factoring fee is calculated by multiplying the invoice value by the fee: $30,000 x 2.5% = $750.

Looking for invoice factoring?

We are a leading invoice factoring company and can provide high advances at low rates. For an instant quote, fill out this form or call us toll-free at (877) 300 3258.