This article covers how to finance a new or growing office cleaning company. It is divided into two sections. The first section discusses resources you can use to finance a new business. The second section covers how to fund operations as your business grows. 1. Financing a new business Financing a new commercial cleaning business […]

Blog

How to Get High-Paying Freight Loads

The most important job for any owner-operator or small fleet owner is finding the best-paying freight loads to haul. For many, this task is the most difficult part of owning a trucking company. Unfortunately, many truckers and owner-operators go out of business because they don’t know how to find good loads. This article shows you […]

How to Find Trucking Contracts

One of the greatest challenges for new owner-operators and small fleet owners is finding loads and long-term trucking contracts. Sadly, this is one of the most common reasons many small trucking companies go out of business. In this article, we cover: (Note: we do not provide trucking contracts. This article is provided for information purposes […]

Should You Offer Early Payment Discounts? (2% / 10 Net 30)

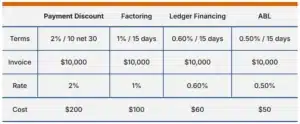

An early payment discount is an incentive that companies receive from suppliers in exchange for a quick payment. It is usually offered by suppliers that need to improve their cash position. In this article, we discuss: 1. Why do you need early payment discounts? Selling to commercial clients can be a challenge for small and […]

Cash Flow Problems Due to Growth

Sales growth has to be managed correctly, or it can actually bring serious problems to a company. Few entrepreneurs ever consider this outcome because they believe all growth is good. But growing sales too quickly, or getting several very large orders, can create serious cash flow problems. These problems can sometimes be severe enough to […]

12 Cash Flow Problems and Solutions

Most small businesses encounter a cash flow problem at one time or another. Fortunately, most cash flow problems can be prevented with a bit of preparation and the right strategy. This article lists the 12 most common causes of cash flow problems, along with ways to solve them. 1. Not having a cash reserve Most […]

7 Ways to Finance Your Construction Company

Getting financing has always been a challenge for construction subcontractors. Banks and financial institutions have strict underwriting criteria and work only with larger companies. This situation creates problems for subcontractors who need financing to run their companies. This article discusses seven ways to finance a small subcontracting business. These options are available to small and […]

Progress Payments Financing for Construction Subcontractors

Progress payments are common in the construction industry. They are also one of the reasons why many factoring companies cannot work with subcontractors in the construction industry. This article discusses how progress payments work, why they are a problem for some factoring companies, and how construction factoring overcomes those issues. We cover: 1. What is […]

Factoring for Owner-Operators

Most truckers become owner-operators because they want more money and the freedom to run their own business. But, above all, they want the opportunity to grow and make a successful trucking company. Unfortunately, most owner-operators experience problems because they don’t have enough money to run the business. They are caught off guard when they don’t […]

Small Business Purchase Order Financing

One of the greatest challenges for small product wholesalers is getting an order too large for them to fulfill. Large orders are good only if you have the financial resources to fulfill them. If you can’t fulfill them, you risk losing the order – and the customer – to a competitor. Being unable to handle […]